EXECUTION VERSION CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS NOT MATERIAL AND IS THE TYPE OF INFORMATION THAT THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS AS PRIVATE AND CONFIDENTIAL. REDACTED INFORMATION IS INDICATED BY [***]. SECURITIES PURCHASE AGREEMENT among NAUTICUS ROBOTICS, INC. and MASTER INVESTMENT GROUP dated as of February 6, 2026

EXECUTION VERSION i TABLE OF CONTENTS Page ARTICLE I Definitions .................................................................................................................. 1 ARTICLE II Purchase and Sale ...................................................................................................... 9 Section 2.01 Purchase and Sale. .......................................................................................... 9 Section 2.02 Transactions Effected at the Closing. ............................................................. 9 Section 2.03 Closing .......................................................................................................... 10 Section 2.04 Use of Proceeds ............................................................................................. 10 Section 2.05 Lock-Up ........................................................................................................ 11 ARTICLE III Representations and Warranties of the Company .................................................. 11 Section 3.01 Organization, Qualification and Authority of the Company ........................ 11 Section 3.02 Capitalization. ............................................................................................... 12 Section 3.03 Reserved. ....................................................................................................... 12 Section 3.04 No Conflicts; Consents ................................................................................. 12 Section 3.05 Financial Statements; Projections. ................................................................ 13 Section 3.06 Undisclosed Liabilities.................................................................................. 13 Section 3.07 Absence of Certain Changes, Events, and Conditions .................................. 14 Section 3.08 Material Contracts. ........................................................................................ 15 Section 3.09 Title to Assets; Real Property. ...................................................................... 16 Section 3.10 Intellectual Property. ..................................................................................... 17 Section 3.11 Inventory ....................................................................................................... 18 Section 3.12 Accounts Receivable ..................................................................................... 18 Section 3.13 Reserved. ....................................................................................................... 19 Section 3.14 Insurance ....................................................................................................... 19 Section 3.15 Legal Proceedings; Governmental Orders. ................................................... 19 Section 3.16 Compliance With Laws; Permits .................................................................. 19 Section 3.17 Environmental Matters.................................................................................. 19 Section 3.18 Employee Benefit Matters. ........................................................................... 20 Section 3.19 Employment Matters. .................................................................................... 22 Section 3.20 Taxes ............................................................................................................. 23 Section 3.21 Books and Records ....................................................................................... 23 Section 3.22 Brokers .......................................................................................................... 24 Section 3.23 Transactions With Affiliates ......................................................................... 24 Section 3.24 Foreign Corrupt Practices Act ...................................................................... 24

EXECUTION VERSION ii Section 3.25 Sanctions; Anti-Terrorism ............................................................................ 24 Section 3.26 Anti-Money Laundering ............................................................................... 24 ARTICLE IV Representations and Warranties of Investor .......................................................... 25 Section 4.01 Organization and Authority of Investor ........................................................ 25 Section 4.02 No Conflicts; Consents ................................................................................. 25 Section 4.03 Reliance on Exemptions ............................................................................... 25 Section 4.04 Brokers .......................................................................................................... 25 Section 4.05 Information Concerning the Company. ........................................................ 26 Section 4.06 Non-Reliance. ............................................................................................... 26 Section 4.07 Status of Investor. ......................................................................................... 27 Section 4.08 Restrictions on Transfer or Sale of Securities. .............................................. 28 Section 4.09 Foreign Corrupt Practices Act ...................................................................... 29 Section 4.10 Sanctions; Anti-Terrorism ............................................................................ 29 Section 4.11 Anti-Money Laundering. .............................................................................. 29 ARTICLE V Conditions to closing ............................................................................................... 30 Section 5.01 Conditions to Obligations of All Parties ....................................................... 30 Section 5.02 Conditions to Obligations of Investor ........................................................... 30 Section 5.03 Conditions to Obligations of the Company .................................................. 31 ARTICLE VI Covenants ............................................................................................................... 32 Section 6.01 Restriction on Access to Government Contracts .......................................... 32 Section 6.02 Further Assurances........................................................................................ 32 Section 6.03 Exercise Cap ................................................................................................. 32 Section 6.04 Stockholder Approval ................................................................................... 32 Section 6.05 Conversion Procedures ................................................................................. 32 Section 6.06 Required Reserve Amount ............................................................................ 33 Section 6.07 Sanctions; Anti-Corruption Laws ................................................................. 33 Section 6.08 Legend........................................................................................................... 33 Section 6.09 CFIUS ........................................................................................................... 33 ARTICLE VII Miscellaneous ....................................................................................................... 34 Section 7.01 Confidentiality; Public Announcements ....................................................... 34 Section 7.02 Expenses ....................................................................................................... 34 Section 7.03 Notices .......................................................................................................... 34 Section 7.04 Interpretation ................................................................................................. 35 Section 7.05 Headings ....................................................................................................... 35

EXECUTION VERSION iii Section 7.06 Severability ................................................................................................... 35 Section 7.07 Entire Agreement .......................................................................................... 36 Section 7.08 Successors and Assigns ................................................................................. 36 Section 7.09 No Third-Party Beneficiaries ........................................................................ 36 Section 7.10 Amendment and Modification; Waiver ........................................................ 36 Section 7.11 Governing Law; Submission to Jurisdiction; Waiver of Jury Trial. ............. 36 Section 7.12 Specific Performance .................................................................................... 37 Section 7.13 Counterparts .................................................................................................. 37

EXECUTION VERSION SECURITIES PURCHASE AGREEMENT This Securities Purchase Agreement (this “Agreement”), dated as of February 6, 2026, is entered into by and among Nauticus Robotics, Inc., a Delaware corporation (the “Company”) and Master Investor Group, a family office organized under the laws of Ras Al Khaima, UAE (the “Investor”). Recitals WHEREAS, the Company has authorized the issuance by the Company of up to 50,000 shares (the “Shares”) of Series D Convertible Preferred Stock, par value $0.0001 per share (the “Series D Preferred Stock”), with the rights, preferences, powers, restrictions, and limitations set forth in the certificate of designation of the Company in the form attached hereto as Exhibit B (the “Certificate of Designation”); WHEREAS, the Company wishes to sell to Investor, and Investor wishes to purchase from the Company, certain common stock purchase warrants (the “Warrants”) for the purchase of shares of the common stock of the Company, par value $0.0001 per share (the “Common Stock”) upon the exercise (the “Warrant Underlying Shares”) which shall be issued to Investor at the initial closings. WHEREAS, the offer and sale of the Series D Preferred Stock, the shares of the underlying Common Stock issuable thereunder (the “Conversion Shares”), the Warrants, and the Warrant Underlying Shares (collectively with the Series D Preferred Stock, the Conversion Shares and the Warrant, the “Securities”) will be made in reliance upon Section 4(a)(2) under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (the “Securities Act”), or upon such other exemption from the registration requirements of the Securities Act as may be available with respect to any or all of the transactions to be made hereunder; WHEREAS, the Company wishes to sell to Investor, and Investor wishes to purchase from the Company, the Securities, subject to the terms and conditions set forth herein; WHEREAS, the parties are concurrently entering into a Registration Rights Agreement in the form attached as Exhibit C hereto (the “Registration Rights Agreement”), pursuant to which the Company shall register the resale of the Registrable Securities (as defined in the Registration Rights Agreement), upon the terms and subject to the conditions set forth therein. NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows: ARTICLE I DEFINITIONS The following terms have the meanings specified or referred to in this ARTICLE I:

EXECUTION VERSION 2 “Action” means any claim, action, cause of action, demand, lawsuit, arbitration, inquiry, audit, notice of violation, proceeding, litigation, citation, summons, subpoena, or investigation of any nature, civil, criminal, administrative, regulatory, or otherwise, whether at law or in equity. “Additional Closing Notice” has the meaning set forth in Section 2.01(b). “Additional Closings” has the meaning set forth in Section 2.01(b). “Additional Preferred Shares” has the meaning set forth in Section 2.01(b). “Additional Warrants” has the meaning set forth in Section 2.01(b). “Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise. “Agreement” has the meaning set forth in the preamble. “Anti-Money Laundering Laws” means Laws and sanctions i) prohibiting transactions with Persons who (1) commit, threaten to commit or support terrorism, (2) engage in transactions or conduct operations that are illegal, nefarious or criminal in nature or (3) participate in monetary transactions in property derived from specified unlawful activity, or ii) otherwise relating to prohibitions in connection with the illegal laundering of the proceeds of any criminal activity and preventing the funds, proceeds and revenue of any Company or their respective Affiliates from being used in connection with the advancement of criminal activity, including, as applicable, the USA PATRIOT Act of 2001 and all “know your customer” rules and other applicable regulations, the Money Laundering Control Act of 1986 and other legislation, which legislative framework is commonly referred to as the “Bank Secrecy Act,” and the corresponding laws of the jurisdictions in which any party operates. “Anti-Terrorism Laws” means any Laws relating to terrorism or money laundering, including Executive Order No. 13224 (effective September 24, 2001), the USA PATRIOT Act, the Laws comprising or implementing the Bank Secrecy Act, and the Laws administered by OFAC (as any of the foregoing laws may from time to time be amended, renewed, extended, or replaced). “Audited Financial Statements” has the meaning set forth in Section 3.05. “Balance Sheet” has the meaning set forth in Section 3.05. “Balance Sheet Date” has the meaning set forth in Section 3.05. “Beneficial Ownership Limitation” has the meaning set forth in Section 6.03. “Benefit Plan” has the meaning set forth in Section 3.18(a).

EXECUTION VERSION 3 “Blocked Person” means (a) a Person who is on the OFAC List of Specially Designated Nationals and Blocked Persons or any other list of Persons who are the subject of Sanctions maintained by OFAC, the U.S. Department of State, His Majesty’s Treasury of the United Kingdom, the European Union or any of its member states, the United Nations Security Council, or any other relevant jurisdiction to the extent they are applicable, (b) any legal entity that is owned, directly or indirectly, thirty percent (30%) or more by one or more Persons identified in the foregoing clause (a), (c) Cuba, Iran, North Korea, the so-called Donetsk People’s Republic, the so-called Luhansk People’s Republic and the Crimea regions of Ukraine, and the non–government controlled areas of the Kherson and Zaporizhzhia oblasts of Ukraine, any Person who is a national or resident thereof or domiciled or headquartered therein, or any legal entity that is organized under the laws of such jurisdiction, (d) a Person on the U.S. Bureau of Industry and Security Denied Persons List, Entity List or Unverified List; (e) listed in the annex to, or is otherwise subject to the provisions of, Executive Order No. 13224, (f) owned or controlled by, or acting for or on behalf of, any Person that is listed in the annex to, or is otherwise subject to the provisions of, Executive Order No. 13224, (g) with which any Investor is prohibited from dealing or otherwise engaging in any transaction by any Anti-Terrorism Law, (h) that commits, threatens or conspires to commit or supports “terrorism” as defined in Executive Order No. 13224; or (i) a Person acting or purporting to act, directly or indirectly, on behalf of, or a legal entity owned or controlled by, any of the Persons identified in any of the foregoing clauses. “Budget” means the expenditure plan and business plan of the Company in the UAE as mutually agreed to by the parties. “Business Day” means any day except Saturday, Sunday, or any other day on which commercial banks located in United States are authorized or required by Law to be closed for business. “CERCLA” means the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended by the Superfund Amendments and Reauthorization Act of 1986, 42 U.S.C. §§ 9601 et seq. “Certificate of Designation” has the meaning set forth in the recitals. “Closing” has the meaning set forth in Section 2.01(b). “Closing Date” has the meaning set forth in Section 2.03. “Code” means the Internal Revenue Code of 1986, as amended. “Common Stock” has the meaning set forth in Section 3.02(a). “Company” has the meaning set forth in the preamble. “Company Competitor” means any company engaged in the business of designing, manufacturing, or producing underwater robotic vehicles or associated software and any company engaged in the business of supplying components for the design, manufacturing or production of underwater robotic vehicles or associated software.

EXECUTION VERSION 4 “Company Intellectual Property” means all Intellectual Property that is owned or held for use by the Company. “Contracts” means all contracts, leases, deeds, mortgages, licenses, instruments, notes, loans, commitments, undertakings, indentures, joint ventures, and all other agreements, commitments, and legally binding arrangements, whether written or oral. “Disclosure Schedules” means the Disclosure Schedules delivered by the Company and Investor concurrently with the execution and delivery of this Agreement. “Disqualified Purchaser” means (a) any Company Competitor, (b) any Affiliate of a Person described in the preceding clause (a) that, in each case, is either reasonably identifiable as such or is identified as such in writing by or on behalf of the Company to the Investor from time to time on or after the applicable Closing Date and (c) unless the Company consents (x) any Affiliate of the Company or (y) any Person that holds more than 5.0% of the Company’s Common Stock, except in the case of this clause (y), any Person that is already an Investor hereunder, so long such Person otherwise became an Investor in accordance with the terms of this Agreement. The Company shall, upon request of Investor, identify whether any Person identified by such Investor as a proposed assignee or participant is a Disqualified Purchaser. “Dollars or $” means the lawful currency of the United States. “Encumbrance” means any charge, claim, community property interest, pledge, condition, equitable interest, lien (statutory or other), option, security interest, mortgage, easement, encroachment, right of way, right of first refusal, or restriction of any kind, including any restriction on use, voting, transfer, receipt of income, or exercise of any other attribute of ownership. “Environmental Claim” means any Action, Governmental Order, lien, fine, penalty, or, as to each, any settlement or judgment arising therefrom, by or from any Person alleging liability of whatever kind or nature (including liability or responsibility for the costs of enforcement proceedings, investigations, cleanup, governmental response, removal or remediation, natural resources damages, property damages, personal injuries, medical monitoring, penalties, contribution, indemnification, and injunctive relief) arising out of, based on or resulting from: (a) the presence, Release of, or exposure to, any Hazardous Materials; or (b) any actual or alleged non-compliance with any Environmental Law or term or condition of any Environmental Permit. “Environmental Law” means any applicable Law, and any Governmental Order or binding agreement with any Governmental Authority: (a) relating to pollution (or the cleanup thereof) or the protection of natural resources, endangered or threatened species, human health or safety, or the environment (including ambient air, soil, surface water or groundwater, or subsurface strata); or (b) concerning the presence of, exposure to, or the management, manufacture, use, containment, storage, recycling, reclamation, reuse, treatment, generation, discharge, transportation, processing, production, disposal, or remediation of any Hazardous Materials. The term “Environmental Law” includes, without limitation, the following (including their implementing regulations and any state analogs): the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended by the Superfund Amendments and

EXECUTION VERSION 5 Reauthorization Act of 1986, 42 U.S.C. §§ 9601 et seq.; the Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act of 1976, as amended by the Hazardous and Solid Waste Amendments of 1984, 42 U.S.C. §§ 6901 et seq.; the Federal Water Pollution Control Act of 1972, as amended by the Clean Water Act of 1977, 33 U.S.C. §§ 1251 et seq.; the Toxic Substances Control Act of 1976, as amended, 15 U.S.C. §§ 2601 et seq.; the Emergency Planning and Community Right-to-Know Act of 1986, 42 U.S.C. §§ 11001 et seq.; the Clean Air Act of 1966, as amended by the Clean Air Act Amendments of 1990, 42 U.S.C. §§ 7401 et seq.; and the Occupational Safety and Health Act of 1970, as amended, 29 U.S.C. §§ 651 et seq. “Environmental Notice” means any written directive, notice of violation or infraction, or notice respecting any Environmental Claim relating to actual or alleged non-compliance with any Environmental Law or any term or condition of any Environmental Permit. “Environmental Permit” means any Permit, letter, clearance, consent, waiver, closure, exemption, decision, or other action required under or issued, granted, given, authorized by, or made pursuant to Environmental Law. “ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated thereunder. “ERISA Affiliate” means, with respect to any Person, any other Person that, together with such first Person, would be treated as a single employer within the meaning of Section 414(b), (c), (m) or (o) of the Code. “Exercise Cap” has the meaning set forth in Section 6.03. “FCPA” means the U.S. Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder. “Financial Statements” has the meaning set forth in Section 3.05. “GAAP” means United States generally accepted accounting principles in effect from time to time. “Government Contract” has the meaning set forth in Section 6.01. “Governmental Authority” means any federal, state, local, or foreign government, or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations, or orders of such organization or authority have the force of Law), or any arbitrator, court, or tribunal of competent jurisdiction. “Governmental Order” means any order, writ, judgment, injunction, decree, stipulation, determination, or award entered by or with any Governmental Authority. “Hazardous Materials” means: (a) any material, substance, chemical, waste, product, derivative, compound, mixture, solid, liquid, mineral, or gas, in each case, whether naturally

EXECUTION VERSION 6 occurring or man-made, that is hazardous, acutely hazardous, toxic, or words of similar import or regulatory effect under Environmental Laws; and (b) any petroleum or petroleum-derived products, radon, radioactive materials or wastes, asbestos in any form, lead or lead-containing materials, urea formaldehyde foam insulation, and polychlorinated biphenyls. “Initial Closing” has the meaning set forth in Section 2.01. “Initial Closing Aggregate Investment Amount” means Section 2.01. “Initial Preferred Shares” has the meaning set forth in Section 2.01. “Initial Warrants” has the meaning set forth in Section 2.01. “Insurance Policies” has the meaning set forth in Section 3.14. “Intellectual Property” has the meaning set forth in Section 3.10(a). “Intellectual Property Registrations” has the meaning set forth in Section 3.10(b). “Interim Balance Sheet” has the meaning set forth in Section 3.05. “Interim Balance Sheet Date” has the meaning set forth in Section 3.05. “Interim Financial Statements” has the meaning set forth in Section 3.05. “Investor” has the meaning set forth in the preamble. “Knowledge of the Company or the Company’s Knowledge” or any other similar knowledge qualification, means the actual or constructive knowledge of any director or officer of the Company, after due inquiry. “Law” means any statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law, judgment, decree, other requirement, or rule of law of any Governmental Authority. “Liabilities” has the meaning set forth in Section 3.06. “Licensed Intellectual Property” means all Intellectual Property in which the Company holds any rights or interests granted by other Persons, including any of its Affiliates. “Lock-Up Period” has the meaning set forth in Section 2.05. “Lock-Up Securities” has the meaning set forth in Section 2.05 “Losses” means losses, damages, liabilities, deficiencies, Actions, judgments, interest, awards, penalties, fines, costs, or expenses of whatever kind, including reasonable attorneys’ fees and the cost of enforcing any right to indemnification hereunder and the cost of pursuing any insurance providers; provided, that “Losses” shall not include punitive damages, except in the case of fraud or to the extent actually awarded to a Governmental Authority or other third party.

EXECUTION VERSION 7 “Material Adverse Effect” means any event, occurrence, fact, condition, or change that is, or could reasonably be expected to become, individually or in the aggregate, materially adverse to the business, results of operations, condition (financial or otherwise), or assets of the Company. “Material Contracts” has the meaning set forth in Section 3.08(a). “Multiemployer Plan” has the meaning set forth in Section 3.18(b). “Permits” means all permits, licenses, franchises, approvals, authorizations, registrations, certificates, variances, and similar rights obtained, or required to be obtained, from Governmental Authorities. “Permitted Encumbrances” has the meaning set forth in Section 3.09(a). “Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association, or other entity. “Proxy Statement” has the meaning set forth in Section 6.04. “Purchased Preferred Shares” has the meaning set forth in Section 2.01. “Purchased Warrants” has the meaning set forth in Section 2.01. “Qualified Benefit Plan” has the meaning set forth in Section 3.18(b). “Real Property” means the real property owned, leased, or subleased by the Company, together with all buildings, structures and facilities located thereon. “Registration Rights Agreement” means the Registration Rights Agreement, dated as of the Closing Date, by and between the Company and the Investor, as such agreement may be amended, restated, or modified from time to time. “Release” means any actual or threatened release, spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, abandonment, disposing, or allowing to escape or migrate into or through the environment (including, without limitation, ambient air (indoor or outdoor), surface water, groundwater, land surface, or subsurface strata or within any building, structure, facility, or fixture). “Representative” means, with respect to any Person, any and all directors, officers, employees, consultants, financial advisors, counsel, accountants, and other agents of such Person. “Required Reserve Amount” has the meaning set forth in Section 6.06. “Sanctions” shall mean collectively, i) all applicable Laws, regulations, executive orders, embargoes and restrictive measures relating to the economic sanctions programs administered by OFAC, the U.S. Department of State, the United Nations and other foreign regulators and respective institutions and agencies, where applicable, ii) all applicable Laws concerning exportation, including rules and regulations administered by the U.S. Department of Commerce,

EXECUTION VERSION 8 the U.S. Department of State or the Bureau of Customs and Border Protection of the U.S. Department of Homeland Security and iii) any anti-boycott laws, including any executive orders, rules and regulations. “SEC Documents” means the reports, schedules, forms, proxy statements, statements and other documents required to be filed by it with the Securities and Exchange Commission pursuant to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and all exhibits and appendices included therein and financial statements, notes and schedules thereto and documents incorporated by reference therein. “Series A Preferred Stock” has the meaning set forth in Section 3.02(a). “Series B Preferred Stock” has the meaning set forth in Section 3.02(a). “Series C Preferred Stock” has the meaning set forth in Section 3.02(a). “Series D Preferred Stock” has the meaning set forth in the Recitals. “Shares” has the meaning set forth in the Recitals. “Stockholder Approval” has the meaning set forth in Section 6.03. “Stockholder Meeting” has the meaning set forth in Section 6.04. “Subject Entity” means any Person, Persons or group or any Affiliate or associate of any such Person, Persons or group. “Subsequent Closing” has the meaning set forth in Section 2.01. “Tax Return” means any return, declaration, report, claim for refund, information return or statement, or other document relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof. “Taxes” means all federal, state, local, foreign and other income, gross receipts, sales, use, production, ad valorem, transfer, franchise, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, customs, duties or other taxes, fees, assessments, or charges of any kind whatsoever, together with any interest, additions, or penalties with respect thereto and any interest in respect of such additions or penalties. “Trading Day” means any day on which (A) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal, in terms of volume, Eligible Exchange on which the Common Stock is listed for trading; and (B) there is no Market Disruption Event, provided that the holder, by written notice to the Corporation, may waive any such Market Disruption Event. If the Common Stock is not so listed or traded, then “Trading Day” means a Business Day.

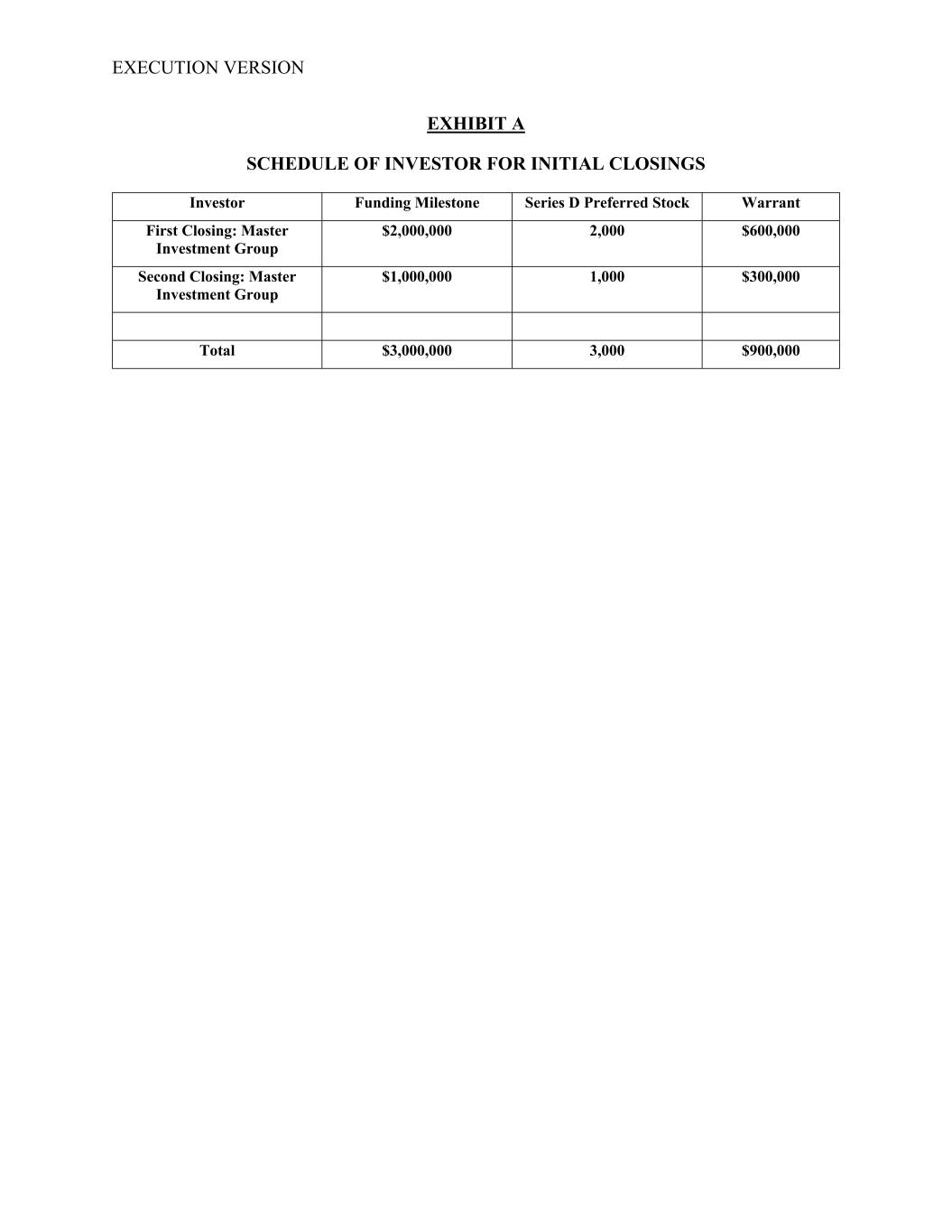

EXECUTION VERSION 9 “Transaction Documents” means this Agreement, the Certificate of Designation, the Warrant Agreement, the Registration Rights Agreement, and all exhibits hereto and thereto. “Union” has the meaning set forth in Section 3.19(b). “Warrant” shall mean that certain common stock purchase warrant for the purchase of shares of the Common Stock which shall be issued to Investor on the date of any Closing under this Agreement. ARTICLE II PURCHASE AND SALE Section 2.01 Purchase and Sale. (a) Initial Closings. Subject to the terms and conditions of this Agreement, Investor severally agrees to purchase, and the Company agrees to sell and issue to Investor, on the dates that each funding milestone is achieved as set forth in Schedule A (the “Initial Closings”), the number of shares of Series D Preferred Stock (the “Initial Preferred Shares”) and the number of Warrants (the “Initial Warrants”) for the prices set forth opposite Investor’s name on Schedule A (the “Initial Closing Aggregate Investment Amount”). The Investor shall pay the Initial Closing Aggregate Investment Amount in the form of direct expenditures made on behalf of Company, the Initial Preferred Shares will be issued by the Company upon the Investor’s demonstration of payment evidence by the presentation of accounts evidencing such expenditures by Investor in form and substance reasonably satisfactory to Company. Any amounts expended by Investor in excess of a milestone as of the date of an Initial Closing shall be credited towards the next Milestone. (b) Subsequent Closings. Subject to the terms and conditions set forth in this Agreement, before the three (3) year-anniversary from the date of this Agreement and subject to extension to such other date mutually agreed by the Company and the Investor, the Company may, upon written request to Investor (the “Additional Closing Notice”), require the Investor to participate in one or more additional Closings (the “Additional Closings”) in which the Company will issue to the Investor additional shares of one or more series of preferred stock of the Company, up to a total of $47,000,000 (the “Additional Preferred Shares”, and together with the Initial Preferred Shares the “Purchased Preferred Shares”), and additional warrants exercisable for an amount of shares of Common Stock with an aggregate initial value equal to thirty percent (30%) of the initial investment amount of such shares of preferred stock of the Company (the “Additional Warrants”, and together with the Initial Warrants, the “Purchased Warrants”), in tranches subject to mutually agreed conversion prices, exercise prices, milestones, assignments, and definitive documentation; provided that, each such Additional Closing is subject to the consent of ATW Special Situations II LLC and its affiliates, as applicable (“ATW”), and any consent(s), if any, otherwise required to be obtained from any investor in the Company’s securities. Each Additional Closing is a “Subsequent Closing” and, together with the Initial Closings, the “Closings” and each, a “Closing”, the day on which the Closing takes place being the “Closing Date”). Section 2.02 Transactions Effected at the Closing.

EXECUTION VERSION 10 (a) At each Closing, Investor shall deliver to the Company: (i) evidence reasonably satisfactory to the Company demonstrating the full expenditure of the applicable Initial Closing Aggregate Investment Amount (the “Purchase Price”) by Investor on behalf of and for the benefit of the Company pursuant to the terms of this Agreement; and (ii) the Transaction Documents and all other agreements, documents, instruments, or certificates required to be delivered by Investor at or prior to the Closing pursuant to Section 5.03 of this Agreement. (b) At each Closing, the Company shall deliver to Investor: (i) stock certificates (or book entry statements) evidencing the applicable Purchased Preferred Shares and warrant certificate evidencing the Warrant on the books and records of the Company, upon request a notice of issuance with respect to the Purchased Preferred Shares being purchased at each applicable Closing by such Investor against payment of the purchase price by check payable to the Company or by wire transfer to a bank account designated by the Company, delivered to the holder no later than five (5) Trading Days after each applicable Closing Date; and (ii) the Transaction Documents and all other agreements, documents, instruments, or certificates required to be delivered by the Company at or prior to the Closing pursuant to Section 5.02 of this Agreement. Section 2.03 Closing. Subject to the terms and conditions of this Agreement, the Closing or Closings contemplated by Section 2.01 shall take place remotely via the electronic exchange of documents and signatures on the applicable Closing Date, with documents being delivered in person, by overnight courier, facsimile, or portable document format (pdf), on such date as the Company and Investor may mutually agree upon in writing (the day on which the Closing takes place being the “Closing Date”). Section 2.04 Use of Proceeds. Subject to the reasonable prior written consent of Investor (provided that such consent requirement shall be satisfied by the Investor’s acceptance and funding of each Closing), the proceeds of each Closing will be deployed exclusively as UAE related working capital to fund and support, directly or indirectly, the establishment and operation of the Company’s business in the United Arab Emirates (UAE). Acceptable uses of proceeds include, but are not limited to, UAE manufacturing facilities, distribution infrastructure, marketing activities, operational setup, working capital, and establishment of business in the UAE as well as other expenditures which relate to and support the operations in the UAE. Proceeds may be dispatched to recipients outside the UAE so long as the proceeds support the business in the UAE. No later than thirty (30) Business Days after the conclusion of each of the Company’s fiscal quarters, concluding with the last fiscal quarter during which Closing proceeds are spent, the Company shall provide to Investor a written record of all transactions involving Closing proceeds from the previous quarter. Upon receipt of such records, Investor shall have ten (10) Business Days to formally dispute any or all of the listed transactions, by delivering a written notice to the

EXECUTION VERSION 11 Company. Failure to properly dispute a transaction within ten (10) Business Days after receipt of Company transactions will be deemed approval of such transactions. Section 2.05 Lock-Up. Notwithstanding anything in this Agreement to the contrary, the Investor agrees with the Company that during the period beginning on the date of each Closing and ending on the date that is two (2) years following each Closing (the “Lock-Up Period”), the Investor will not, without prior consent from the Company and ATW, directly or indirectly, (i) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, or otherwise dispose of or transfer any shares of Common Stock issuable upon conversion of the Purchased Preferred Shares (collectively, “Lock-Up Securities”), whether now owned or hereafter acquired by such Investor or with respect to which such Investor has or hereafter acquires the power of disposition, or (ii) enter into any swap or any other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of the Lock-Up Securities, whether any such swap or transaction is to be settled by delivery of Common Stock or other securities, in cash or otherwise. For the avoidance of doubt, this Section 2.05 shall not apply to any shares of Common Stock underlying any Purchased Warrants. ARTICLE III REPRESENTATIONS AND WARRANTIES OF THE COMPANY Except as set forth in the correspondingly numbered Section of the Disclosure Schedules and otherwise as disclosed in the SEC Documents, the Company represents and warrants to Investor that the statements contained in this ARTICLE III are true and correct as of the date hereof. Section 3.01 Organization, Qualification and Authority of the Company. The Company is a corporation duly organized, validly existing, and in good standing under the Laws of the state of Delaware and has full corporate power and authority to (a) enter into this Agreement and the other Transaction Documents to which the Company is a party, to carry out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby and (b) own, operate, or lease the properties and assets now owned, operated, or leased by it and to carry on its business as it has been and is currently conducted. The Company is duly licensed or qualified to do business and is in good standing in each jurisdiction in which the properties owned or leased by it or the operation of its business as currently conducted makes such licensing or qualification necessary. The execution and delivery by the Company of this Agreement and any other Transaction Document to which the Company is a party, the performance by the Company of its obligations hereunder and thereunder, and the consummation by the Company of the transactions contemplated hereby and thereby have been duly authorized by all requisite corporate action on the part of the Company. This Agreement has been duly executed and delivered by the Company, and (assuming due authorization, execution, and delivery by Investor) this Agreement constitutes a legal, valid, and binding obligation of the Company enforceable against the Company in accordance with its terms. When each other Transaction Document to which the Company is or will be a party has been duly executed and delivered by the Company (assuming due authorization, execution, and delivery by each other party thereto), such Transaction Document will constitute a legal and binding obligation of the Company enforceable against it in accordance with its terms.

EXECUTION VERSION 12 Section 3.02 Capitalization. (a) Section 3.02(a) of the Disclosure Schedules sets forth the capitalization table of the Company as of immediately prior to the transaction contemplated by the Agreement. (b) As of immediately following the Closing after giving effect to the transactions contemplated by this Agreement, (i) all of the issued and outstanding shares of capital stock of the Company will have been duly authorized, validly issued, fully paid, and non- assessable, and will be owned of record and beneficially as set forth on Section 3.02(a) of the Disclosure Schedules, (ii) all of the issued and outstanding shares of capital stock of the Company will have been issued in compliance with all applicable federal and state securities Laws, (iii) none of the issued and outstanding shares of capital stock of the Company will have been issued in violation of any agreement, arrangement, or commitment to which the Company or any of its Affiliates is a party or is subject to or in violation of any preemptive or similar rights of any Person, and (iv) all of the Shares will have the rights, preferences, powers, restrictions, and limitations set forth in the Certificate of Designation and under the Delaware General Corporation Law. The shares of Common Stock issuable upon conversion of the Shares in accordance with the Certificate of Designation have been duly reserved for issuance and, upon such issuance, such shares of Common Stock will be (x) duly authorized, validly issued, fully paid, and non-assessable and (y) issued in compliance with applicable all federal and state securities Laws. (c) Except as set forth on Section 3.02(c) of the Disclosure Schedules, the Company does not have outstanding, authorized, or in effect any stock appreciation, phantom stock, profit participation, or similar rights. Except as set forth on Section 3.02(c) of the Disclosure Schedules, there are no voting trusts, stockholder agreements, proxies, or other agreements, understandings, or obligations in effect with respect to the voting, transfer or sale (including any rights of first refusal, rights of first offer, or drag-along rights), issuance (including any pre- emptive or anti-dilution rights), redemption or repurchase (including any put or call or buy-sell rights), or registration (including any related lock-up or market standoff agreements) of any shares of capital stock or other securities of the Company. Section 3.03 Reserved. Section 3.04 No Conflicts; Consents. The execution, delivery, and performance by the Company of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) conflict with or result in a violation or breach of, or default under, any provision of the certificate of incorporation, by-laws, or other organizational documents of the Company; (b) conflict with or result in a violation or breach of any provision of any Law or Governmental Order applicable to the Company; (c) except as set forth in Section 3.04 of the Disclosure Schedules, require the consent or waiver of, notice to, or other action by any Person under, conflict with, result in a violation or breach of, constitute a default or an event that, with or without notice or lapse of time or both, would constitute a default under, result in the acceleration of, or create in any party the right to accelerate, terminate, modify, or cancel any Contract to which the Company is a party or by which the Company is bound or to which any of its properties and assets are subject (including any Material Contract) or any Permit affecting the properties, assets, or business of the Company; or (d) result in the creation or imposition of any Encumbrance other than Permitted Encumbrances

EXECUTION VERSION 13 on any properties or assets of the Company. No consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority is required by or with respect to the Company in connection with the execution and delivery of this Agreement and the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby. Section 3.05 Financial Statements; Projections. (a) Complete copies of the Company’s audited financial statements consisting of the Balance Sheet of the Company as at December 31 in each of the years 2022, 2023 and 2024 and the related statements of income and retained earnings, stockholders’ equity, and cash flow for the years then ended (the “Audited Financial Statements”), and unaudited financial statements consisting of the Balance Sheet of the Company as at September 30, 2025 and the related statements of income and retained earnings, stockholders’ equity, and cash flow for the nine-month period then ended (the “Interim Financial Statements” and together with the Audited Financial Statements, the “Financial Statements”) are included in the periodic reports required to be filed by the Company with the SEC pursuant to the reporting requirements of the 1934 Act. The Financial Statements have been prepared in accordance with GAAP applied on a consistent basis throughout the period involved, subject, in the case of the Interim Financial Statements, to normal and recurring year-end adjustments (the effect of which will not be materially adverse) and the absence of notes (that, if presented, would not differ materially from those presented in the Audited Financial Statements). The Financial Statements are based on the books and records of the Company, and fairly present in all material respects the financial condition of the Company as of the respective dates they were prepared and the results of the operations of the Company for the periods indicated. The audited balance sheet of the Company as of December 31, 2024 is referred to herein as the “Balance Sheet” and the date thereof as the “Balance Sheet Date” and the balance sheet of the Company as of September 30, 2025 is referred to herein as the “Interim Balance Sheet” and the date thereof as the “Interim Balance Sheet Date”. The Company maintains a standard system of accounting established and administered in accordance with GAAP. (b) Investor hereby acknowledges that (i) projections are inherently subject to substantial and numerous uncertainties and to a wide variety of significant business, economic. and competitive risks, and the assumptions underlying the projections may be inaccurate in any material respect, (ii) Investor is familiar with such uncertainties, risks, and potential inaccuracies and takes full responsibility for making its own evaluation of the adequacy and accuracy of all projections (including the reasonableness of the assumptions underlying such projections), (iii) the actual results achieved may vary significantly from the forecasts, and the variations may be material, and (iv) the projections have not been compiled, audited, or examined by independent accountants and have not been prepared in accordance with GAAP. Therefore, the Company makes no representations or warranties whatsoever regarding such projections, their accuracy, or the Company’s ability to achieve forecasted results and Investor shall have no claim against the Company or any other Person with respect thereto. Section 3.06 Undisclosed Liabilities. Except, the Company has no liabilities, obligations, or commitments of any nature whatsoever, asserted or unasserted, known or unknown, absolute or contingent, accrued or unaccrued, matured or unmatured, or otherwise (“Liabilities”) of a type required to be reflected on a balance sheet prepared in accordance with GAAP, except

EXECUTION VERSION 14 (a) those as set forth on Section 3.06 of the Disclosure Schedules, (b) those which are adequately reflected or reserved against in the Balance Sheet as of the Balance Sheet Date, and (c) those which have been incurred in the ordinary course of business consistent with past practice since the Balance Sheet Date and which are not, individually or in the aggregate, material in amount. Section 3.07 Absence of Certain Changes, Events, and Conditions. Since the Balance Sheet Date, and other than in the ordinary course of business consistent with past practice or as set forth on Section 3.07(a) of the Disclosure Schedules, there has not been, with respect to the Company, any: (a) event, occurrence, or development that has had, or could reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect; (b) amendment of the charter, by-laws, or other organizational documents of the Company; (c) split, combination, or reclassification of any shares of its capital stock; (d) issuance, sale, or other disposition of any of its capital stock, or grant of any options, warrants, or other rights to purchase or obtain (including upon conversion, exchange, or exercise) any of its capital stock; (e) declaration or payment of any dividends or distributions on or in respect of any of its capital stock or redemption, purchase, or acquisition of its capital stock; (f) material change in any method of accounting or accounting practice of the Company, except as required by GAAP or as disclosed in the notes to the Financial Statements; (g) incurrence, assumption, or guarantee of any indebtedness for borrowed money except unsecured current obligations and Liabilities incurred in the ordinary course of business consistent with past practice; (h) transfer, assignment, sale, or other disposition of any of the assets shown or reflected in the Balance Sheet or cancellation, discharge, or payment of any material debts, liens, or entitlements; (i) transfer, assignment, or grant of any license or sublicense of any material rights under or with respect to any Intellectual Property; (j) any capital investment in, or any loan to, any other Person; (k) acceleration, termination, material modification or amendment to, or cancellation of any material contract (including, but not limited to, any Material Contract) to which the Company is a party or by which it is bound; (l) any material capital expenditures;

EXECUTION VERSION 15 (m) imposition of any Encumbrance upon any of the Company properties, capital stock, or assets, tangible or intangible; (n) adoption, modification, or termination of any: (i) material employment, severance, retention, or other agreement with any current or former employee, officer, director, independent contractor, or consultant, (ii) Benefit Plan, or (iii) collective bargaining or other agreement with a Union, in each case whether written or oral; (o) any loan to (or forgiveness of any loan to), or entry into any other transaction with, any of its stockholders, directors, officers, and employees; (p) entry into a new line of business or abandonment or discontinuance of existing lines of business; (q) adoption of any plan of merger, consolidation, reorganization, liquidation, or dissolution or filing of a petition in bankruptcy under any provisions of federal or state bankruptcy Law or consent to the filing of any bankruptcy petition against it under any similar Law; (r) acquisition by merger or consolidation with, or by purchase of a substantial portion of the assets or stock of, or by any other manner, any business or any Person or any division thereof; or (s) any Contract to do any of the foregoing, or any action or omission that would result in any of the foregoing. Section 3.08 Material Contracts. (a) Section 3.08(a) of the Disclosure Schedules lists each of the following Contracts of the Company (such Contracts, together with all Contracts concerning the occupancy, management, or operation of any Real Property (including without limitation, brokerage contracts) listed or otherwise disclosed in Section 3.09(b) of the Disclosure Schedules and all Contracts relating to Intellectual Property set forth in Section 3.10(d) and Section 3.10(f) of the Disclosure Schedules, being “Material Contracts”): (i) each Contract of the Company involving aggregate consideration in excess of $500,000 and which, in each case, cannot be cancelled by the Company without penalty or without more than 90 days’ notice; (ii) all Contracts that require the Company to purchase its total requirements of any product or service from a third party or that contain “take or pay” provisions; (iii) all Contracts that provide for the indemnification by the Company of any Person or the assumption of any Tax, environmental, or other Liability of any Person; (iv) all Contracts that relate to the acquisition or disposition of any business, a material amount of stock or assets of any other Person, or any real property (whether by merger, sale of stock, sale of assets, or otherwise);

EXECUTION VERSION 16 (v) all broker, distributor, dealer, manufacturer’s representative, franchise, agency, sales promotion, market research, marketing consulting, and advertising Contracts to which the Company is a party; (vi) all employment agreements and Contracts with independent contractors or consultants (or similar arrangements) to which the Company is a party and which are not cancellable without material penalty or without more than 90 days’ notice; (vii) except for Contracts relating to trade receivables, all Contracts relating to indebtedness (including, without limitation, guarantees) of the Company; (viii) all Contracts with any Governmental Authority to which the Company is a party; (ix) all Contracts that limit or purport to limit the ability of the Company to compete in any line of business or with any Person or in any geographic area or during any period of time; (x) any Contracts to which the Company is a party that provide for any joint venture, partnership, or similar arrangement by the Company; (xi) all collective bargaining agreements or Contracts with any Union to which the Company is a party; and (xii) any other Contract that is material to the Company and not previously disclosed pursuant to this Section 3.08. (b) Each Material Contract is valid and binding on the Company in accordance with its terms and is in full force and effect. None of the Company or, to the Company’s Knowledge, any other party thereto is in breach of or default under (or is alleged to be in breach of or default under), in any material respect, or has provided or received any notice of any intention to terminate, any Material Contract. No event or circumstance has occurred that, with notice or lapse of time or both, would constitute an event of default under any Material Contract or result in a termination thereof or would cause or permit the acceleration or other changes of any right or obligation or the loss of any benefit thereunder. Complete and correct copies of each Material Contract (including all modifications, amendments, and supplements thereto, and waivers thereunder) have been made available to Investor. Section 3.09 Title to Assets; Real Property. (a) The Company has good and valid (and, in the case of owned Real Property, good and marketable fee simple) title to, or a valid leasehold interest in, all Real Property, and other assets reflected in the Audited Financial Statements or acquired after the Balance Sheet Date, other than properties and assets sold or otherwise disposed of in the ordinary course of business consistent with past practice since the Balance Sheet Date. All such properties and assets (including leasehold interests) are free and clear of Encumbrances except for the following (collectively referred to as “Permitted Encumbrances”):

EXECUTION VERSION 17 (i) those items set forth in Section 3.09(a) of the Disclosure Schedules; (ii) liens for Taxes not yet due and payable or being contested in good faith by appropriate procedures and for which there are adequate accruals or reserves on the Balance Sheet; (iii) mechanics, carriers’, workmen’s, repairmen’s, or other like liens arising or incurred in the ordinary course of business consistent with past practice or amounts that are not delinquent and which are not, individually or in the aggregate, material to the business of the Company; (iv) easements, rights of way, zoning ordinances, and other similar Encumbrances affecting Real Property which are not, individually or in the aggregate, material to the business of the Company; or (v) other than with respect to owned Real Property, liens arising under original purchase price conditional sales contracts and equipment leases with third parties entered into in the ordinary course of business consistent with past practice which are not, individually or in the aggregate, material to the business of the Company. Section 3.10 Intellectual Property. (a) “Intellectual Property” means any and all trademarks and domain names; original works of authorship and related copyrights; trade secrets, whether or not patentable; designs and inventions and related patents; and similar intangible property in which any Person holds proprietary rights, title, interests, or protections, however arising, pursuant to the Laws of any jurisdiction throughout the world, all applications, registrations, renewals, issues, reissues, extensions, divisions, and continuations in connection with any of the foregoing and the goodwill connected with the use of and symbolized by any of the foregoing. (b) Section 3.10(b) of the Disclosure Schedules lists all Company Intellectual Property that is either (i) subject to any issuance, registration, application, or other filing by, to, or with any Governmental Authority or authorized private registrar in any jurisdiction (collectively, “Intellectual Property Registrations”), including registered trademarks, domain names, and copyrights, issued and reissued patents, and pending applications for any of the foregoing; or (ii) used in or necessary for the Company’s current or planned business or operations. All required filings and fees related to the Intellectual Property Registrations have been timely filed with and paid to the relevant Governmental Authorities and authorized registrars, and all Intellectual Property Registrations are otherwise in good standing. (c) The Company owns, exclusively or jointly with other Persons, all right, title, and interest in and to the Company Intellectual Property, free and clear of Encumbrances. Without limiting the generality of the foregoing, the Company has entered into binding, written agreements with every current and former employee of the Company, and with every current and former independent contractor, whereby such employees and independent contractors (i) assign to the Company any ownership interest and right they may have in the Company Intellectual Property; and (ii) acknowledge the Company’s exclusive ownership of all Company Intellectual

EXECUTION VERSION 18 Property. The Company is in full compliance with all legal requirements applicable to the Company Intellectual Property and the Company’s ownership and use thereof. (d) Section 3.10(d) of the Disclosure Schedules lists all licenses, sublicenses, and other agreements whereby the Company is granted rights, interests, and authority, whether on an exclusive or non-exclusive basis, with respect to any Licensed Intellectual Property that is used in or necessary for the Company’s current or planned business or operations. All such agreements are valid, binding, and enforceable between the Company and the other parties thereto, and the Company and such other parties are in full compliance with the terms and conditions of such agreements. (e) The Company Intellectual Property and Licensed Intellectual Property as currently or formerly owned, licensed, or used by the Company or proposed to be used, and the Company’s conduct of its business as currently and formerly conducted and proposed to be conducted have not, do not, and will not infringe, violate, or misappropriate the Intellectual Property of any Person. The Company has not received any communication, and no Action has been instituted, settled or, to the Company’s Knowledge, threatened that alleges any such infringement, violation, or misappropriation, and none of the Company Intellectual Property are subject to any outstanding Governmental Order. (f) Section 3.10(f) of the Disclosure Schedules lists all licenses, sublicenses, and other agreements pursuant to which the Company grants rights or authority to any Person with respect to any Company Intellectual Property or Licensed Intellectual Property. All such agreements are valid, binding, and enforceable between the Company and the other parties thereto, and the Company and such other parties are in full compliance with the terms and conditions of such agreements. No Person has infringed, violated, or misappropriated, or is infringing, violating, or misappropriating, any Company Intellectual Property. Section 3.11 Inventory. All inventory of the Company, whether or not reflected in the Balance Sheet, consists of a quality and quantity usable and salable in the ordinary course of business consistent with past practice, except for obsolete, damaged, defective, or slow-moving items that have been written off or written down to fair market value or for which adequate reserves have been established. All such inventory is owned by the Company free and clear of all Encumbrances, and no inventory is held on a consignment basis. The quantities of each item of inventory (whether raw materials, work-in-process, or finished goods) are not excessive, but are reasonable in the present circumstances of the Company. Section 3.12 Accounts Receivable. The accounts receivable reflected on the Interim Balance Sheet and the accounts receivable arising after the date thereof (a) have arisen from bona fide transactions entered into by the Company involving the sale of goods or the rendering of services in the ordinary course of business consistent with past practice; and (b) constitute only valid, undisputed claims of the Company not subject to claims of set-off or other defenses or counterclaims other than normal cash discounts accrued in the ordinary course of business consistent with past practice. The reserve for bad debts shown on the Interim Balance Sheet or, with respect to accounts receivable arising after the Interim Balance Sheet Date, on the accounting records of the Company have been determined in accordance with GAAP, consistently applied, subject to normal year-end adjustments and the absence of disclosures normally made in footnotes.

EXECUTION VERSION 19 Section 3.13 Reserved. Section 3.14 Insurance. Section 3.14 of the Disclosure Schedules sets forth a true and complete list of all current policies or binders of fire, liability, product liability, umbrella liability, real and personal property, workers’ compensation, vehicular, directors’ and officers’ liability, fiduciary liability, and other casualty and property insurance maintained by the Company or its Affiliates and relating to the assets, business, operations, employees, officers, and directors of the Company (collectively, the “Insurance Policies”). Such Insurance Policies are in full force and effect and shall remain in full force and effect following the consummation of the transactions contemplated by this Agreement. Neither the Company nor any of its Affiliates has received any written notice of cancellation of, premium increase with respect to, or alteration of coverage under, any of such Insurance Policies. The Insurance Policies are of the type and in the amounts customarily carried by Persons conducting a business similar to the Company and are sufficient for compliance with all applicable Laws and Contracts to which the Company is a party or by which it is bound. Except as set forth on Section 3.14 of the Disclosure Schedules, there are no claims related to the business of the Company pending under any such Insurance Policies as to which coverage has been questioned, denied, or disputed or in respect of which there is an outstanding reservation of rights. Section 3.15 Legal Proceedings; Governmental Orders. (a) Except as set forth in Section 3.15(a) of the Disclosure Schedules, there are no Actions pending or, to the Company’s Knowledge, threatened against or by the Company affecting any of its properties or assets (or by or against the Company or any Affiliate thereof and relating to the Company). (b) Except as set forth in Section 3.15(b) of the Disclosure Schedules, there are no outstanding Governmental Orders and no unsatisfied judgments, penalties, or awards against or affecting the Company or any of its properties or assets. Section 3.16 Compliance With Laws; Permits. All Permits required for the Company to conduct its business have been obtained by it and are valid and in full force and effect. All fees and charges with respect to such Permits as of the date hereof have been paid in full. No event has occurred that, with or without notice or lapse of time or both, would reasonably be expected to result in the revocation, suspension, lapse, or limitation of any current Permits issued to the Company. Section 3.17 Environmental Matters. (a) The Company is currently and has been in compliance with all Environmental Laws and has not received from any Person any: (i) Environmental Notice or Environmental Claim; or (ii) written request for information pursuant to Environmental Law, which, in each case, either remains pending or unresolved, or is the source of ongoing obligations or requirements as of the Closing Date. (b) The Company has obtained and is in material compliance with all Environmental Permits necessary for the ownership, lease, operation, or use of the business or assets of the Company and all such Environmental Permits will be in full force and effect through

EXECUTION VERSION 20 the Closing Date in accordance with Environmental Law, and the Company is not aware of any condition, event, or circumstance that might prevent or impede, after the Closing Date, the ownership, lease, operation, or use of the business or assets of the Company as currently carried out. (c) No real property currently or formerly owned, operated, or leased by the Company is listed on, or has been proposed for listing on, the National Priorities List (or CERCLIS) under CERCLA, or any similar state list. (d) There has been no Release of Hazardous Materials in contravention of Environmental Law with respect to the business or assets of the Company or any real property currently or formerly owned, operated, or leased by the Company, and the Company has not received an Environmental Notice that any real property currently or formerly owned, operated, or leased in connection with the business of the Company (including soils, groundwater, surface water, buildings, and other structure located on any such real property) has been contaminated with any Hazardous Material which could reasonably be expected to result in an Environmental Claim against, or a violation of Environmental Law or term of any Environmental Permit by, the Company. (e) The Company has not retained or assumed, by contract or operation of Law, any liabilities or obligations of third parties under Environmental Law. (f) The Company has provided or otherwise made available to Investor and listed in Section 3.17(h) of the Disclosure Schedules: (i) any and all environmental reports, studies, audits, records, sampling data, site assessments, risk assessments, economic models, and other similar documents with respect to the business or assets of the Company or any currently or formerly owned, operated, or leased real property which are in the possession or control of the Company related to compliance with Environmental Laws, Environmental Claims, or an Environmental Notice or the Release of Hazardous Materials; and (ii) any and all material documents concerning planned or anticipated capital expenditures required to reduce, offset, limit, or otherwise control pollution and/or emissions, manage waste, or otherwise ensure compliance with current or future Environmental Laws (including, without limitation, costs of remediation, pollution control equipment, and operational changes). (g) The Company is not aware of and does not reasonably anticipate, any condition, event or circumstance concerning the Release or regulation of Hazardous Materials that might prevent, impede, or materially increase the costs associated with the ownership, lease, operation, performance, or use of the business or assets of the Company as currently carried out. Section 3.18 Employee Benefit Matters. (a) Section 3.18(a) of the Disclosure Schedules contains a true and complete list of each pension, benefit, retirement, compensation, profit-sharing, deferred compensation, incentive, performance award, phantom equity, stock or stock-based, change in control, retention, severance, vacation, paid time off, fringe-benefit and other similar agreement, plan, policy, program, or arrangement (and any amendments thereto), in each case whether or not reduced to writing and whether funded or unfunded, including each “employee benefit plan” within the

EXECUTION VERSION 21 meaning of Section 3(3) of ERISA, whether or not tax-qualified and whether or not subject to ERISA, which is or has been maintained, sponsored, contributed to, or required to be contributed to by the Company for the benefit of any current or former employee, officer, director, retiree, independent contractor, or consultant of the Company or any spouse or dependent of such individual, or under which the Company has or may have any Liability, or with respect to which Investor or any of its Affiliates would reasonably be expected to have any Liability, contingent or otherwise (as listed on Section 3.18(a) of the Disclosure Schedules, each, a “Benefit Plan”). With respect to each Benefit Plan, the Company has made available to Investor accurate, current, and complete copies of each of the following: (i) where the Benefit Plan has been reduced to writing, the plan document together with all amendments; (ii) where the Benefit Plan has not been reduced to writing, a written summary of all material plan terms; and (iii) in the case of any Benefit Plan that is intended to be qualified under Section 401(a) of the Code, a copy of the most recent determination, opinion, or advisory letter from the Internal Revenue Service. (b) Each Benefit Plan (other than any multiemployer plan within the meaning of Section 3(37) of ERISA (each a “Multiemployer Plan”)) has been established, administered, and maintained in accordance with its terms and in compliance with all applicable Laws (including ERISA and the Code). Each Benefit Plan that is intended to be qualified under Section 401(a) of the Code (a “Qualified Benefit Plan”) is so qualified and has received a favorable and current determination letter from the Internal Revenue Service, or with respect to a prototype plan, can rely on an opinion letter from the Internal Revenue Service to the prototype plan sponsor, to the effect that such Qualified Benefit Plan is so qualified and that the plan and the trust related thereto are exempt from federal income taxes under Sections 401(a) and 501(a), respectively, of the Code, and nothing has occurred that could reasonably be expected to cause the revocation of such determination letter from the Internal Revenue Service or the unavailability of reliance on such opinion letter from the Internal Revenue Service, as applicable, nor has such revocation or unavailability been threatened. Nothing has occurred with respect to any Benefit Plan that has subjected or could reasonably be expected to subject the Company to a penalty under Section 502 of ERISA or to tax or penalty under Section 4975 of the Code. All benefits, contributions, and premiums relating to each Benefit Plan have been timely paid in accordance with the terms of such Benefit Plan and all applicable Laws and accounting principles, and all benefits accrued under any unfunded Benefit Plan have been paid, accrued, or otherwise adequately reserved to the extent required by, and in accordance with, GAAP. There is no pending or, to the Company’s Knowledge, threatened Action relating to a Benefit Plan (other than routine claims for benefits). (c) Neither the Company nor any of its ERISA Affiliates has (i) incurred or reasonably expects to incur, either directly or indirectly, any material Liability under Title I or Title IV of ERISA or related provisions of the Code or foreign Law relating to employee benefit plans; (ii) failed to timely pay premiums to the Pension Benefit Guaranty Corporation; (iii) withdrawn from any Benefit Plan; or (iv) engaged in any transaction which would give rise to liability under Section 4069 or Section 4212(c) of ERISA. (d) With respect to each Benefit Plan (i) no such plan is a Multiemployer Plan, and all contributions required to be paid by the Company or its ERISA Affiliates have been timely paid to the applicable Multiemployer Plan; (ii) no such plan is a “multiple employer plan” within the meaning of Section 413(c) of the Code or a “multiple employer welfare arrangement” (as defined in Section 3(40) of ERISA); (iii) no Action has been initiated by the Pension Benefit

EXECUTION VERSION 22 Guaranty Corporation to terminate any such plan or to appoint a trustee for any such plan; (iv) no such plan is subject to the minimum funding standards of Section 302 of ERISA or Section 412 of the Code; and (v) no “reportable event,” as defined in Section 4043 of ERISA, has occurred with respect to any such plan. (e) Other than as required under Section 601 et. seq. of ERISA or other applicable Law, no Benefit Plan provides post-termination or retiree welfare benefits to any individual for any reason, and neither the Company nor any of its ERISA Affiliates has any Liability to provide post-termination or retiree welfare benefits to any individual. (f) Neither the execution of this Agreement nor any of the transactions contemplated by this Agreement will (either alone or upon the occurrence of any additional or subsequent events): (i) entitle any current or former director, officer, employee, independent contractor, or consultant of the Company to severance pay or any other payment; (ii) accelerate the time of payment, funding, or vesting, or increase the amount of compensation due to any such individual; (iii) limit or restrict the right of the Company to merge, amend, or terminate any Benefit Plan; or (iv) increase the amount payable under or result in any other material obligation pursuant to any Benefit Plan. Section 3.19 Employment Matters. (a) As of the date hereof, all compensation, including wages, commissions, and bonuses, payable to employees, independent contractors, or consultants of the Company for services performed on or prior to the date hereof have been paid in full (or accrued in full on the audited balance sheet contained in the Closing Working Capital Statement) and there are no outstanding agreements, understandings, or commitments of the Company with respect to any employment, compensation, commissions, or bonuses. (b) The Company is not, and has not been for the past two (2) years, a party to, bound by, or negotiating any collective bargaining agreement or other Contract with a union, works council, or labor organization (collectively, “Union”), and there is not, and has not been for the past two (2) years, any Union representing or purporting to represent any employee of the Company, and, to the Company’s Knowledge, no Union or group of employees is seeking or has sought to organize employees for the purpose of collective bargaining. There has never been, nor has there been any threat of, any strike, slowdown, work stoppage, lockout, concerted refusal to work overtime, or other similar labor disruption or dispute affecting the Company or any of its employees. The Company has no duty to bargain with any Union. (c) The Company is and has been in compliance in all material respects with all applicable Laws pertaining to employment and employment practices, including all Laws relating to labor relations, equal employment opportunities, fair employment practices, employment discrimination, harassment, retaliation, reasonable accommodation, disability rights or benefits, immigration, wages, hours, overtime compensation, child labor, hiring, promotion and termination of employees, working conditions, meal and break periods, privacy, health and safety, workers’ compensation, leaves of absence, and unemployment insurance. All individuals characterized and treated by the Company as independent contractors or consultants are properly treated as independent contractors under all applicable Laws. All employees classified as exempt