SEATREPID INTERNATIONAL, LLC Consolidated Financial Statements As of and for the years ended December 31, 2024 and 2023 With Report of Independent Auditors

SEATREPID INTERNATIONAL, LLC CONSOLIDATED FINANCIAL STATEMENTS For the Years Ended December 31, 2024 and 2023 TABLE OF CONTENTS PAGE Report of Independent Auditors 2 Consolidated Balance Sheets 4 Consolidated Statements of Operations 5 Consolidated Statements of Changes in Members’ Deficit 6 Consolidated Statements of Cash Flows 7 Notes to the Consolidated Financial Statements 8

Houston Office 3737 Buffalo Speedway Suite 1600 Houston, Texas 77098 713.621.1515 Main whitleypenn.com 2 REPORT OF INDEPENDENT AUDITORS To the Members SeaTrepid International, LLC Opinion We have audited the consolidated financial statements of SeaTrepid International, LLC and its subsidiaries (collectively referred to as the “Company”), which comprise the consolidated balance sheets as of December 31, 2024 and 2023, and the related consolidated statements of operations, changes in members’ deficit, and cash flows for the years then ended, and the related notes to the consolidated financial statements. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2024 and 2023, and the results of their operations and their cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (“GAAS”). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company, and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with GAAP, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the consolidated financial statements are issued. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud

3 is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit. Houston, Texas May 28, 2025

4 SEATREPID INTERNATIONAL, LLC CONSOLIDATED BALANCE SHEETS (in thousands) December 31, 2024 December 31, 2023 Assets Current Assets: Cash and cash equivalents $ 234 $ 466 Accounts receivable, net of allowance for credit losses of $551 and $399 as of December 31, 2024 and 2023, respectively 509 1,187 Accrued revenue - 160 Prepaid expenses 122 76 Other current assets, related party 73 - Total current assets 938 1,889 Property and equipment, net 2,115 1,907 Total Assets $ 3,053 $ 3,796 Liabilities and Members’ Deficit Current Liabilities: Accounts payable $ 622 $ 1,844 Accrued liabilities 88 423 Notes payable, current portion 2,348 116 Other current liabilities 103 97 Contract liabilities - 250 Total current liabilities 3,161 2,730 Notes payable, net of current portion - 2,301 Total Liabilities 3,161 5,031 Commitments and Contingencies (Note 8) Total Members’ Deficit (108) (1,235) Total Liabilities and Members’ Deficit $ 3,053 $ 3,796

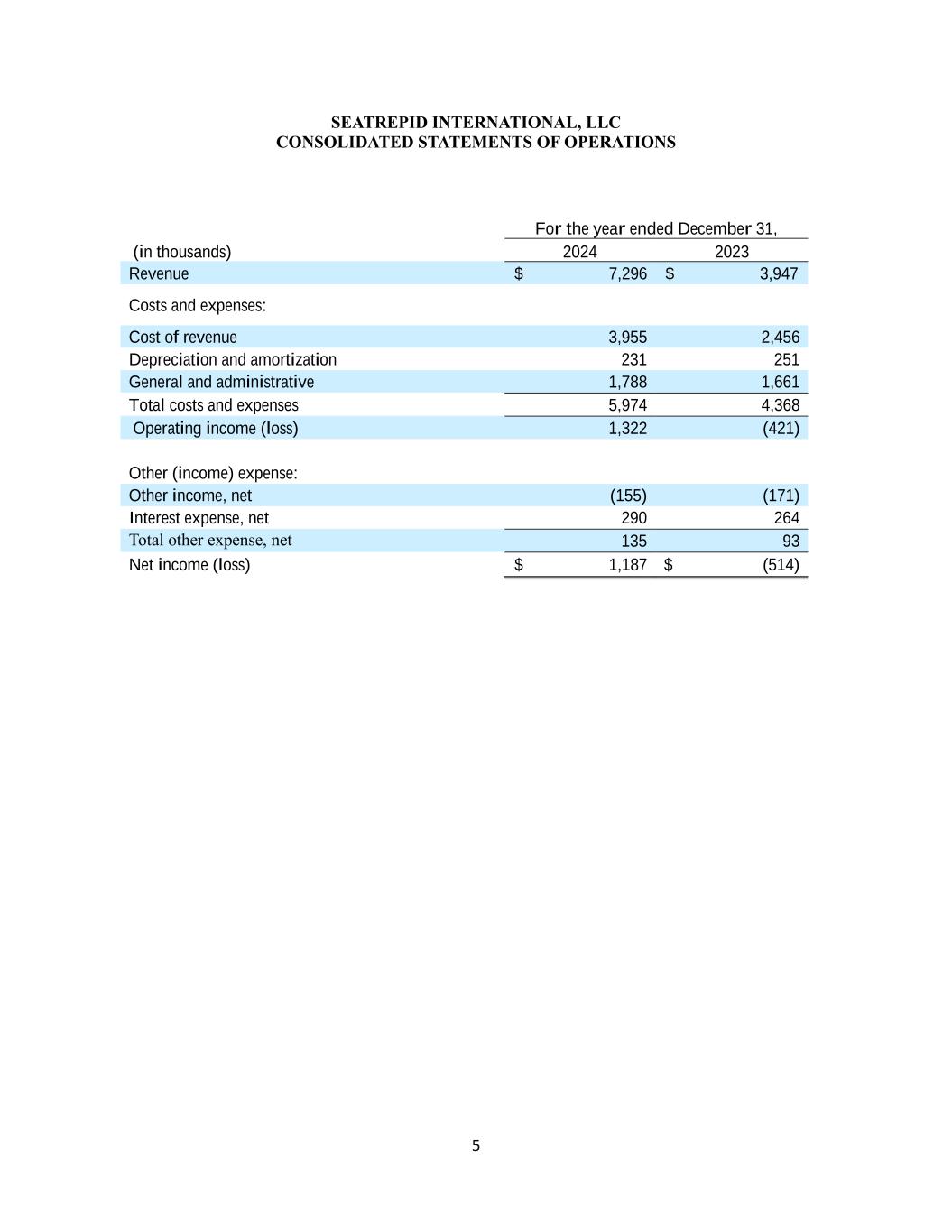

5 SEATREPID INTERNATIONAL, LLC CONSOLIDATED STATEMENTS OF OPERATIONS For the year ended December 31, (in thousands) 2024 2023 Revenue $ 7,296 $ 3,947 Costs and expenses: Cost of revenue 3,955 2,456 Depreciation and amortization 231 251 General and administrative 1,788 1,661 Total costs and expenses 5,974 4,368 Operating income (loss) 1,322 (421) Other (income) expense: Other income, net (155) (171) Interest expense, net 290 264 Total other expense, net 135 93 Net income (loss) $ 1,187 $ (514)

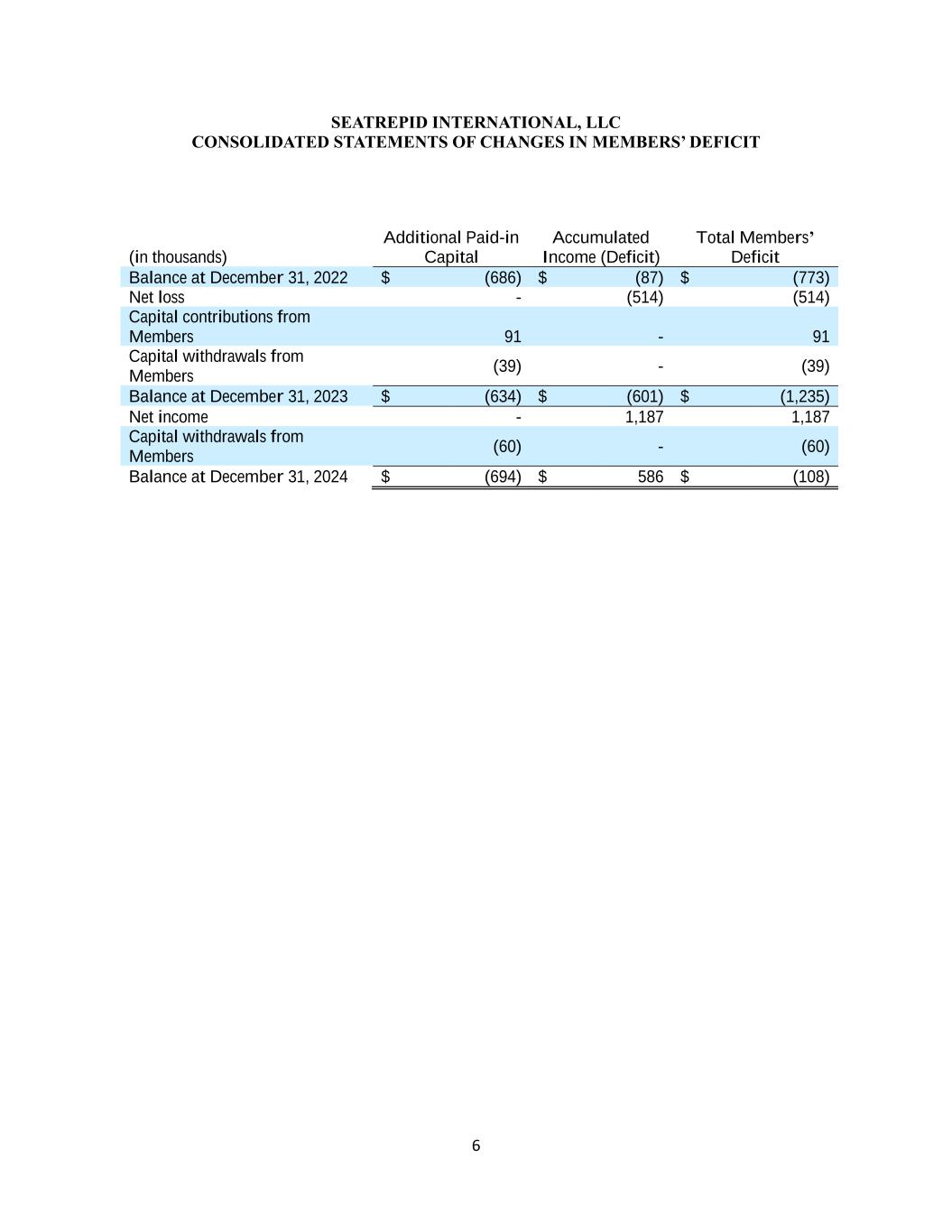

6 SEATREPID INTERNATIONAL, LLC CONSOLIDATED STATEMENTS OF CHANGES IN MEMBERS’ DEFICIT Additional Paid-in Capital Accumulated Income (Deficit) Total Members’ Deficit (in thousands) Balance at December 31, 2022 $ (686) $ (87) $ (773) Net loss - (514) (514) Capital contributions from Members 91 - 91 Capital withdrawals from Members (39) - (39) Balance at December 31, 2023 $ (634) $ (601) $ (1,235) Net income - 1,187 1,187 Capital withdrawals from Members (60) - (60) Balance at December 31, 2024 $ (694) $ 586 $ (108)

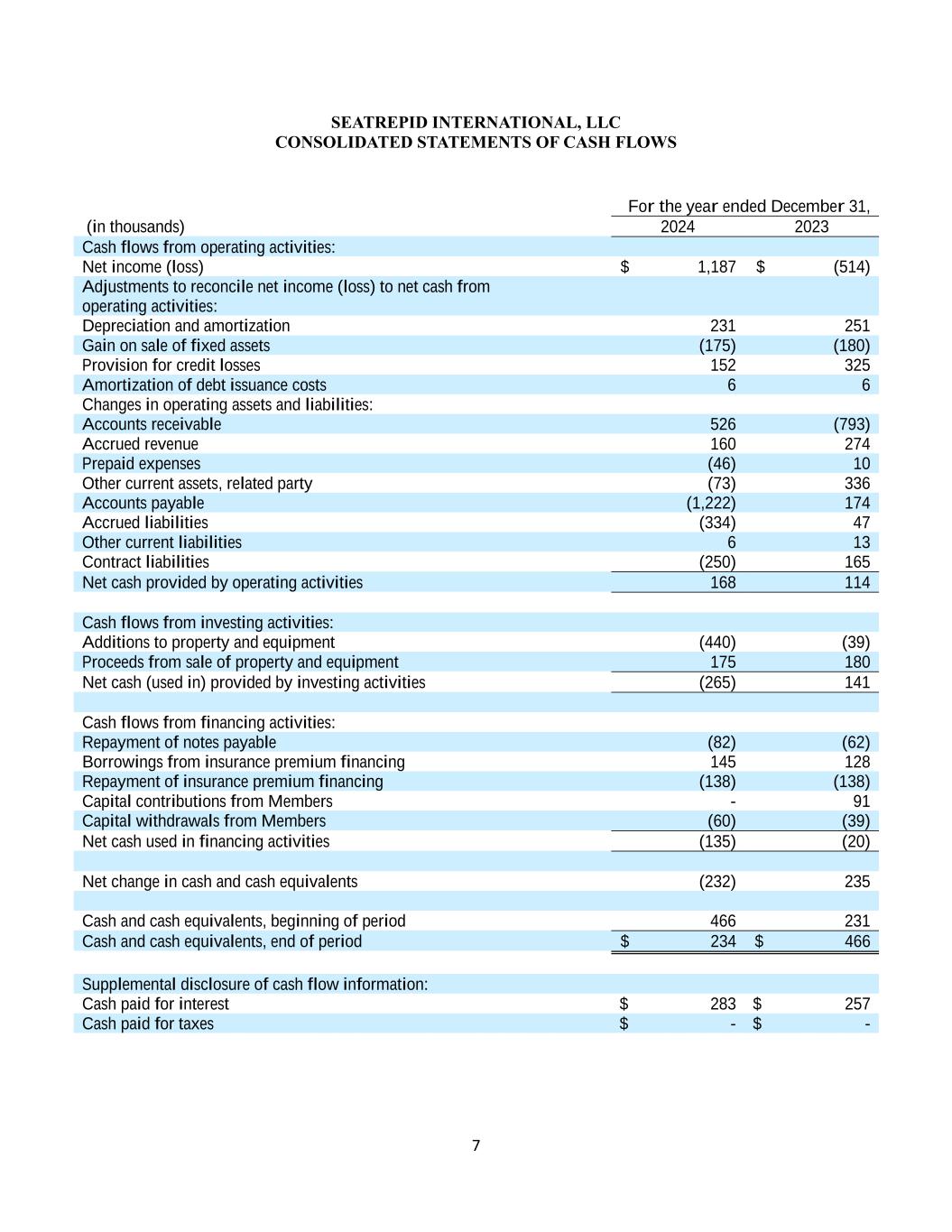

7 SEATREPID INTERNATIONAL, LLC CONSOLIDATED STATEMENTS OF CASH FLOWS For the year ended December 31, (in thousands) 2024 2023 Cash flows from operating activities: Net income (loss) $ 1,187 $ (514) Adjustments to reconcile net income (loss) to net cash from operating activities: Depreciation and amortization 231 251 Gain on sale of fixed assets (175) (180) Provision for credit losses 152 325 Amortization of debt issuance costs 6 6 Changes in operating assets and liabilities: Accounts receivable 526 (793) Accrued revenue 160 274 Prepaid expenses (46) 10 Other current assets, related party (73) 336 Accounts payable (1,222) 174 Accrued liabilities (334) 47 Other current liabilities 6 13 Contract liabilities (250) 165 Net cash provided by operating activities 168 114 Cash flows from investing activities: Additions to property and equipment (440) (39) Proceeds from sale of property and equipment 175 180 Net cash (used in) provided by investing activities (265) 141 Cash flows from financing activities: Repayment of notes payable (82) (62) Borrowings from insurance premium financing 145 128 Repayment of insurance premium financing (138) (138) Capital contributions from Members - 91 Capital withdrawals from Members (60) (39) Net cash used in financing activities (135) (20) Net change in cash and cash equivalents (232) 235 Cash and cash equivalents, beginning of period 466 231 Cash and cash equivalents, end of period $ 234 $ 466 Supplemental disclosure of cash flow information: Cash paid for interest $ 283 $ 257 Cash paid for taxes $ - $ -

8 SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS December 31, 2024 and 2023 1. Description of the Business SeaTrepid International, LLC and its subsidiaries (collectively the “Company” or “SeaTrepid”) is a leading innovator in gas and oil exploration, providing a comprehensive range of services to commercial, governmental, and scientific communities. The Company specializes in the development and implementation of advanced equipment and techniques aimed at reducing risks to personnel, enabling operations in hazardous environments, and delivering exceptional results to customers under the guiding principle of "A Higher Standard of Excellence." SeaTrepid delivers subsea, terrestrial, and aerial solutions tailored to specific customer needs. By leveraging a highly skilled and versatile workforce, the Company continuously develops, innovates, and deploys cutting-edge solutions that enhance operational efficiency and safety. With a strong reputation built on a proven track record of success, SeaTrepid delivers superior services at a more cost-effective standard compared to competitors. The Company places a strong emphasis on safety and training, ensuring that field service technicians are thoroughly prepared to execute tasks safely and effectively. This commitment to excellence, innovation, and customer satisfaction positions SeaTrepid as a trusted partner in the exploration and operational support industries. The Company is headquartered in Robert, Louisiana. 2. Summary of Significant Accounting Policies Basis of Presentation – The accompanying consolidated financial statements have been prepared and are maintained and the consolidated financial statements have been prepared using the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”), in the opinion of management, include all adjustments (consisting of normal, recurring adjustments, unless otherwise disclosed) necessary for a fair statement of the consolidated results of operations, financial position, cash flows and changes in Members’ deficit for each period presented. The consolidated financial statements include the accounts of the Company and its subsidiaries, all of which are wholly owned. All intercompany balances and transactions have been eliminated in preparation of these consolidated financial statements. Use of Estimates – The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates. Cash and Cash Equivalents – The Company classifies all highly-liquid instruments with an original maturity of three months or less as cash equivalents. The Company maintains substantially all of its cash and cash equivalents in bank deposit accounts at a single financial institution, which at times may exceed federally insured limits of $250 thousand. Historically, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant credit risk on its cash balances. The Company periodically assesses the financial stability of the financial institution and considers the bank to be financially stable. There were no cash equivalents at December 31, 2024 and 2023, respectively.

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 9 Accounts Receivable and Allowance for Credit Losses – Accounts receivable are stated at amounts management expects to collect from outstanding balances. Credit is extended to customers based upon evaluation of the customer’s financial condition, and collateral is not required. Management provides for probable uncollectible amounts through a charge to earnings and an expected allowance for credit losses based on its assessment of the status of individual accounts. Balances still outstanding after management has used reasonable collection efforts are written off through a charge to the allowance and a credit to accounts receivable. Effective January 1, 2023, the Company adopted Accounting Standards Update (ASU) 2016-13, Financial Instruments – Credit Losses (Topic 326), which replaces the existing incurred loss impairment model with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The adoption of ASC 326 did not have a material impact on the Company’s consolidated financial statements. The Company estimates its allowance for credit losses based on historical experience, current economic conditions, customer-specific factors, and reasonable and supportable forecasts. The estimation approach may vary by portfolio segment, considering the risk profile of the underlying receivables. The allowance is recorded through a provision for credit losses in the consolidated statements of operations and is reviewed at each reporting date. The following table presents changes in the allowance for credit losses for the years ended December 31, 2024 and 2023: (in thousands) December 31, 2024 December 31, 2023 Beginning Balance $ 399 $ 181 Provision for Credit Losses 152 325 Write-offs - (107) Ending Balance $ 551 $ 399 Revenue – Provision of Remotely Operated Vehicle (“ROV”) and Autonomous Underwater Vehicle (“AUV”) services for offshore and inland operations includes integrated ROV/AUV support services (equipment and personnel) for the duration specified or implied by the contract terms. The equipment (ROVs, cameras, generators, etc.) and personnel (supervisors, pilots/techs, etc.) are highly interdependent and integrated inputs used to deliver the single, combined output of ROV support services required by the customer. Revenue Recognition Policy: In accordance with the Financial Accounting Standards Board's (FASB) Accounting Standards Codification (ASC) Topic 606, "Revenue from Contracts with Customers," SeaTrepid recognizes revenue by applying the following five-step model: 1. Identify the Contract with a Customer: SeaTrepid enters into written agreements with its clients, detailing the scope of work, duration, pricing, and specific obligations of both parties. 2. Identify the Performance Obligations in the Contract: Each contract is evaluated to determine distinct performance obligations, which may include: o Provision of ROV/AUV services for inspections or surveys.

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 10 o Provision of specific robotic equipment. o Delivery of training sessions or consulting services. 3. Determine the Transaction Price: The transaction price is established based on contract terms, considering fixed amounts, variable considerations (such as performance bonuses, penalties or billing of project incurred costs back to the client on a cost + basis), and any discounts. 4. Allocate the Transaction Price to the Performance Obligations: If a contract includes multiple performance obligations, the transaction price is allocated based on the standalone selling prices of each distinct service or product. If standalone prices are not directly observable, they are estimated using appropriate methods. 5. Recognize Revenue When (or As) the Entity Satisfies a Performance Obligation: Service Contracts: Revenue from integrated ROV/AUV support services – comprising both equipment and personnel – is recognized over the duration specified or implied by the contract, as the services are rendered. Provision of Equipment: Revenue is recognized based on the number of days the equipment is provided to the customer, in accordance with the daily rate specified in the contract. Provision of Personnel: This includes personnel required to fulfill the primary ROV/AUV support services. It also encompasses mobilization and demobilization efforts necessary to ensure uninterrupted service delivery. Revenue is recognized using input-based methods, such as the number of utilized days and applicable rates, depending on the nature of the service provided. In some cases, SeaTrepid issues invoices on a lump-sum basis. However, the invoiced amounts are derived from the underlying provision of equipment and personnel as described above and are consolidated into a single line item on the invoice. Principal vs. Agent Considerations: In certain arrangements, SeaTrepid acts as an agent rather than a principal. This typically occurs when the Company arranges for the service to be provided by another party. SeaTrepid does not appear to control the underlying goods or services prior to transfer. In such cases, SeaTrepid recognizes revenue on a net basis, equal to the amount billed to the customer less any amounts paid to third-party service providers. The Company does not collect or remit sales, use, value-added, or similar taxes from customers. Accordingly, no such taxes are included in revenues or expenses. SeaTrepid's revenue recognition policies are designed to comply with ASC 606, ensuring that revenue is recognized in a manner that accurately reflects the transfer of goods and services to customers. Accounts Receivable Factoring – The Company has entered into a factoring arrangement with Gulf Coast Bank & Trust, under which it sells certain trade receivables on a with-recourse basis. Since the Company retains the risk of credit loss on the receivables, the transactions do not qualify for sale treatment under ASC Topic 860 – Transfers and Servicing. Therefore, the Company continues to recognize the receivables on its consolidated balance sheet and records the cash received as a secured borrowing. Under the terms of the agreement, the Company receives an initial advance of 85% of the invoice value at the time of transfer, with the remaining 15% held by the factor as a reserve. The reserve is remitted to the Company upon customer payment, net of fees and interest.

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 11 During the years ended December 31, 2024, and 2023, the Company factored approximately $4.7 million and $2.0 million, respectively, in gross trade receivables. The fees and interest expense associated with these factoring transactions amounted to $40 thousand and $41 thousand for the years ended December 31, 2024 and 2023, respectively. As of December 31, 2024 and 2023, the Company had a liability of $0 related to the factoring arrangement. Property and Equipment – Property and equipment is recorded at cost and depreciated using the straight- line method. Expenditures which extend the useful lives of existing property and equipment are capitalized. Those costs which do not extend the useful lives are expensed as incurred. Upon disposition, the cost and accumulated depreciation are removed and any gain or loss on the disposal is reflected in the consolidated statements of operations. Impairment of Long-Lived Assets - The Company reviews long-lived assets for potential impairment when events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. In this assessment, future pre-tax cash flows (undiscounted) resulting from the use of the asset and its eventual disposal are estimated. If the undiscounted future cash flows are less than the carrying amount of the asset, an impairment loss is recognized for the difference between its carrying value and estimated fair value. For the year ended December 31, 2024 and 2023, no property and equipment was impaired. Income Taxes – The Company is organized as a limited liability company (LLC) and is treated as a pass- through entity for federal and applicable state income tax purposes. As a result, the Company does not pay income taxes at the entity level. Instead, all items of income, deductions, gains, and losses are reported on the individual tax returns of the members. Accordingly, no provision or liability for federal or state income taxes has been included in these financial statements. The Company may, however, be subject to certain state and local taxes, including gross receipts or franchise taxes, which are included in general and administrative expenses. The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which a change in judgment occurs. The Company had no material uncertain tax positions as of December 31, 2024 or 2023. Leases – The Company determines whether an arrangement is or contains a lease at inception. The Company has elected the short-term lease exemption permitted under ASC Topic 842 – Leases, and does not recognize right-of-use assets or lease liabilities for leases with terms of 12 months or less. Lease payments under these arrangements are recognized on a straight-line basis over the lease term. The Company’s lease arrangements consist primarily of equipment leases, all of which are short-term in nature. As of December 31, 2024 and 2023, the Company did not have any leases that require recognition of right-of-use assets or lease liabilities under ASC 842. Lease expense for short-term leases was approximately $1.5 million and $0.7 million for the years ended December 31, 2024 and 2023, respectively, and is included in cost of revenue in the consolidated statements of operations.

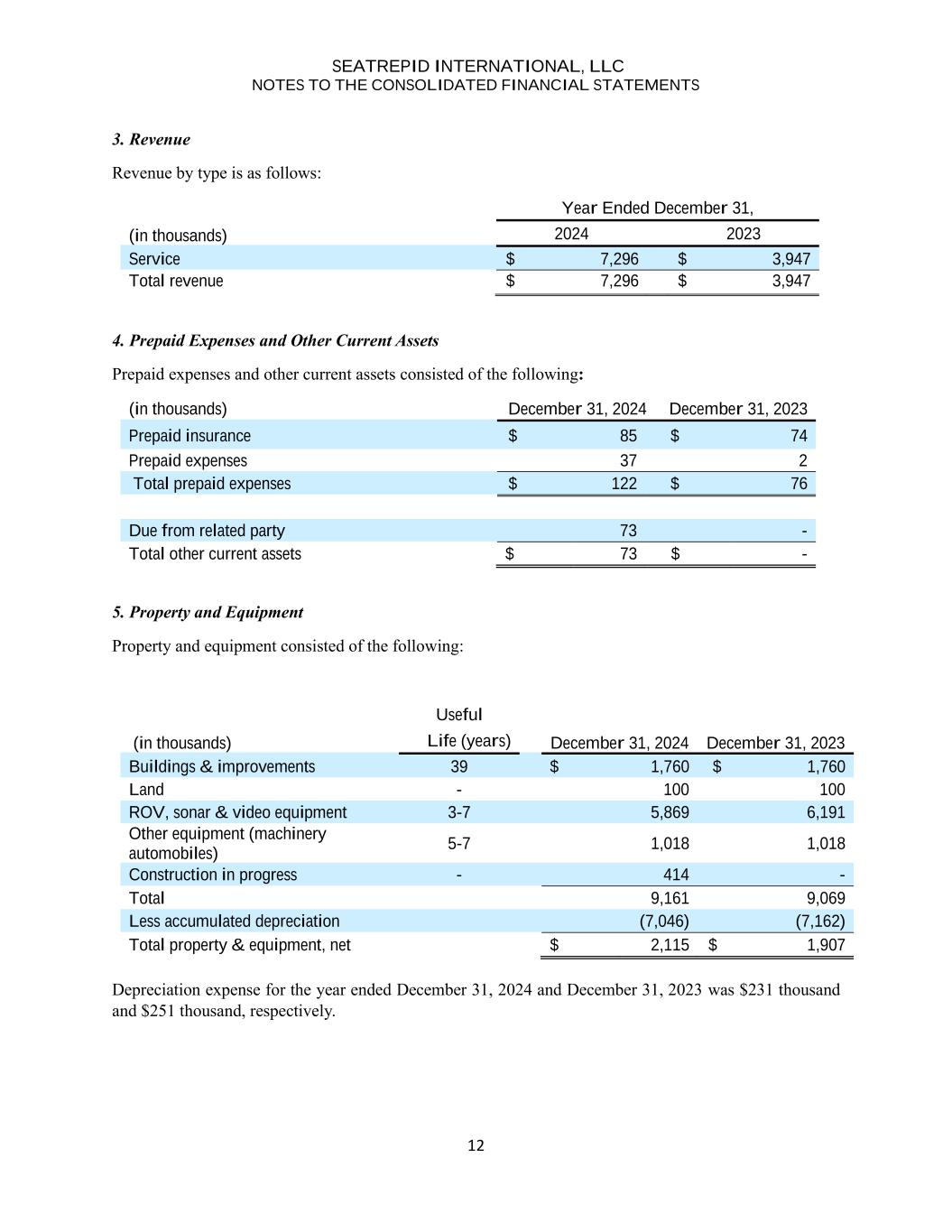

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 12 3. Revenue Revenue by type is as follows: Year Ended December 31, (in thousands) 2024 2023 Service $ 7,296 $ 3,947 Total revenue $ 7,296 $ 3,947 4. Prepaid Expenses and Other Current Assets Prepaid expenses and other current assets consisted of the following: (in thousands) December 31, 2024 December 31, 2023 Prepaid insurance $ 85 $ 74 Prepaid expenses 37 2 Total prepaid expenses $ 122 $ 76 Due from related party 73 - Total other current assets $ 73 $ - 5. Property and Equipment Property and equipment consisted of the following: (in thousands) Useful December 31, 2024 December 31, 2023 Life (years) Buildings & improvements 39 $ 1,760 $ 1,760 Land - 100 100 ROV, sonar & video equipment 3-7 5,869 6,191 Other equipment (machinery automobiles) 5-7 1,018 1,018 Construction in progress - 414 - Total 9,161 9,069 Less accumulated depreciation (7,046) (7,162) Total property & equipment, net $ 2,115 $ 1,907 Depreciation expense for the year ended December 31, 2024 and December 31, 2023 was $231 thousand and $251 thousand, respectively.

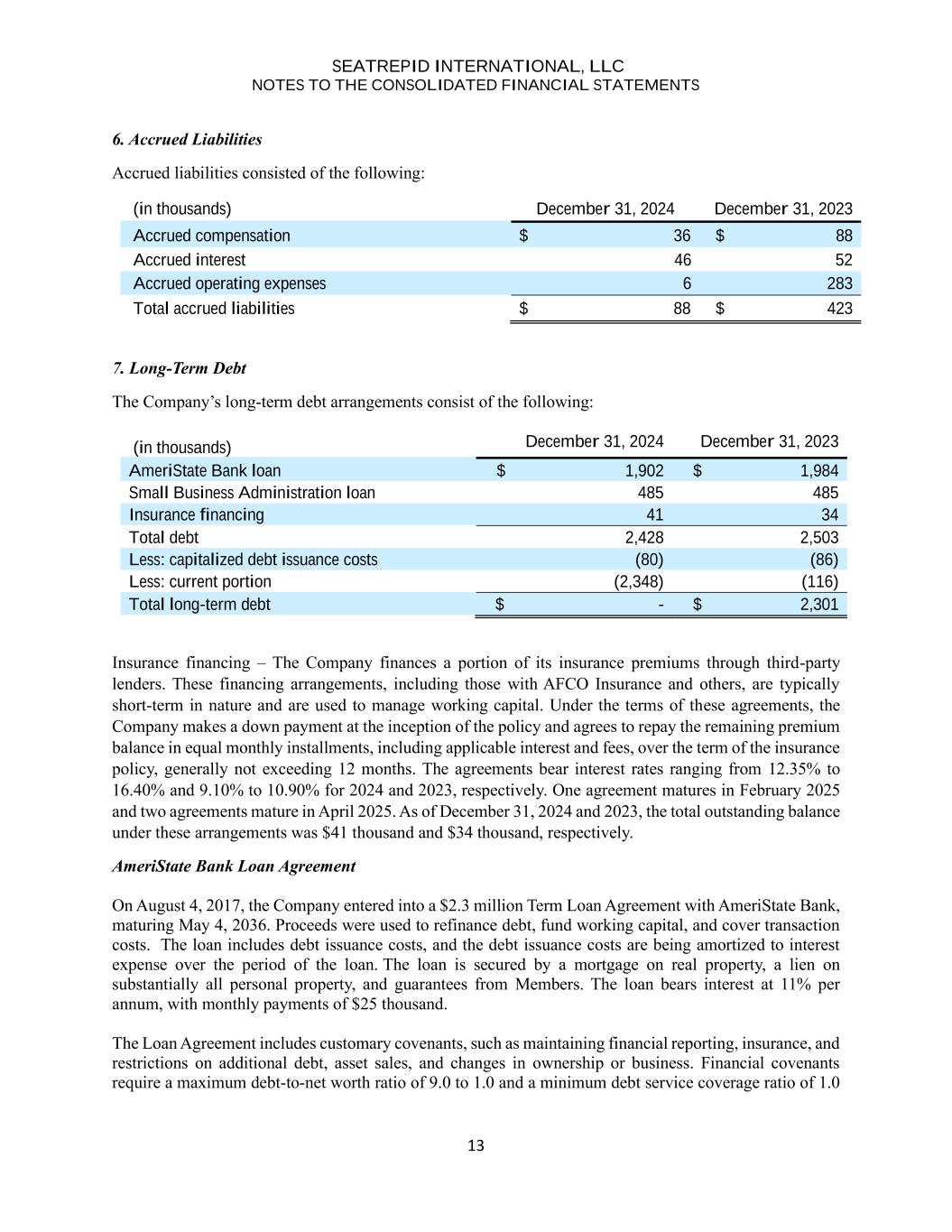

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 13 6. Accrued Liabilities Accrued liabilities consisted of the following: (in thousands) December 31, 2024 December 31, 2023 Accrued compensation $ 36 $ 88 Accrued interest 46 52 Accrued operating expenses 6 283 Total accrued liabilities $ 88 $ 423 7. Long-Term Debt The Company’s long-term debt arrangements consist of the following: (in thousands) December 31, 2024 December 31, 2023 AmeriState Bank loan $ 1,902 $ 1,984 Small Business Administration loan 485 485 Insurance financing 41 34 Total debt 2,428 2,503 Less: capitalized debt issuance costs (80) (86) Less: current portion (2,348) (116) Total long-term debt $ - $ 2,301 Insurance financing – The Company finances a portion of its insurance premiums through third-party lenders. These financing arrangements, including those with AFCO Insurance and others, are typically short-term in nature and are used to manage working capital. Under the terms of these agreements, the Company makes a down payment at the inception of the policy and agrees to repay the remaining premium balance in equal monthly installments, including applicable interest and fees, over the term of the insurance policy, generally not exceeding 12 months. The agreements bear interest rates ranging from 12.35% to 16.40% and 9.10% to 10.90% for 2024 and 2023, respectively. One agreement matures in February 2025 and two agreements mature in April 2025. As of December 31, 2024 and 2023, the total outstanding balance under these arrangements was $41 thousand and $34 thousand, respectively. AmeriState Bank Loan Agreement On August 4, 2017, the Company entered into a $2.3 million Term Loan Agreement with AmeriState Bank, maturing May 4, 2036. Proceeds were used to refinance debt, fund working capital, and cover transaction costs. The loan includes debt issuance costs, and the debt issuance costs are being amortized to interest expense over the period of the loan. The loan is secured by a mortgage on real property, a lien on substantially all personal property, and guarantees from Members. The loan bears interest at 11% per annum, with monthly payments of $25 thousand. The Loan Agreement includes customary covenants, such as maintaining financial reporting, insurance, and restrictions on additional debt, asset sales, and changes in ownership or business. Financial covenants require a maximum debt-to-net worth ratio of 9.0 to 1.0 and a minimum debt service coverage ratio of 1.0

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 14 to 1.0. As of December 31, 2024 and 2023, the outstanding principal balance was $1.9 million and $2.0 million, respectively. As of December 31, 2024, the Company was not in compliance with the financial covenants related to the debt-to-net worth ratio and debt service coverage ratio. This non-compliance represents an event of default under the Loan Agreement. The lender has not accelerated the loan or taken any enforcement action as of the date of this report. U.S. Small Business Administration (“SBA”) – Economic Injury Disaster Loan On June 19, 2020, SeaTrepid International, LLC entered into a $485 thousand Economic Injury Disaster Loan (“EIDL”) with the U.S. Small Business Administration. The loan bears interest at 3.75% per annum and matures 30 years from the date of the note, with monthly payments of $2 thousand beginning 12 months after disbursement. The loan is secured by all tangible and intangible property of the Borrower and is guaranteed by Members. The EIDL includes restrictions on asset transfers, distributions, and changes in business structure without SBA consent, as well as requirements to maintain insurance and submit financial statements. As of December 31, 2024 and December 31, 2023, the outstanding principal balance was $485 thousand for both years. The loan balance did not change over the years due to hardship nature of the loan, which principal was exempted for repayment during the reporting periods. On March 20, 2025, the Company sold all of its assets to Nauticus Robotics, Inc., which constituted a breach of certain covenants under its outstanding loan agreements. As a result of this breach, the lenders - AmeriState Bank and the U.S. Small Business Administration may demand repayment of the outstanding principal balances during 2025. Accordingly, as of December 31, 2024, the Company reclassified the outstanding loan principal balances from long-term to short-term liabilities in the total amount of $2.4 million (including principal of $0.5 million from the U.S. Small Business Administration and $1.9 million from AmeriState Bank). Interest expense, net related to notes payable was $290 and $264 for the years ended December 31, 2024 and 2023, respectively. 8. Commitments and Contingencies The Company is involved in certain legal proceedings and disputes as described below. Litigation In May 2023, an incident involving a chartered vessel resulted in damage to Company-owned subsea equipment, including a Remotely Operated Vehicle (ROV), and led to recovery and refurbishment costs of approximately $258 thousand due from customer. Following the incident, a dispute arose with a vendor related to services provided under the charter arrangement, and litigation is currently ongoing. The matter was moved to U.S. District Court, where the Company has asserted counterclaims against multiple parties, including the vessel operator and the vessel in rem, alleging breach of contract, negligence, and vessel unseaworthiness. As of December 31, 2024 and 2023, the Company has recorded an accounts receivable provision of $258 thousand related to the dispute. The case is currently in the discovery phase, with trial expected later in the current fiscal year.

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 15 While the ultimate outcome of this matter cannot be predicted with certainty, management currently believes that a resolution may be reached in which each party bears its own losses. Based on information available as of the date of these financial statements, management does not believe that the resolution of this matter will have a material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows. Subcontract Dispute The Company is involved in a pre-litigation commercial dispute with a third party related to a subcontract entered into in July 2024. The counterparty has alleged breach of contract and/or negligent performance, claiming potential damages of up to $300 thousand to complete the remaining work. The Company disputes the allegations and believes any issues stemmed from factors outside of its control, including incorrect third-party specifications and other external actions. As of December 31, 2024, the Company has recorded an accounts receivable provision of approximately $146 thousand related to this matter. While settlement discussions are ongoing, no formal legal proceedings have been initiated. The outcome of the matter and any potential financial impact remain uncertain and cannot be reasonably estimated at this time. 9. Concentrations of Credit Risk and Significant Customers The Company has a limited number of customers. For the year ended December 31, 2024, two customers accounted for approximately 68% of total revenues, with individual customer concentrations of 49% and 19%. For the year ended December 31, 2023, the three customers accounted for approximately 53% of total revenues, with individual customer concentrations of 28%, 13%, and 12%. As of December 31, 2024, five customers accounted for approximately 96% of total accounts receivable. Individually, they represented 30%, 24%, 15%, 14%, and 13%. As of December 31, 2023, two customers accounted for approximately 82% of total accounts receivable. Individually, they represented 66% and 16%. The Company provides offshore services primarily in the Gulf of Mexico and performs ongoing credit evaluations of its customers’ financial condition. The Company does not require collateral and maintains an allowance for potential credit losses. Management believes the credit risk associated with these receivables is mitigated by the Company’s established relationships and positive payment history with these customers. The loss of any of these key customers could have a material adverse effect on the Company’s financial condition and results of operations. 10. Employee Benefit Plan The Company sponsors the SeaTrepid 401(k) Plan (the “Plan”), a qualified retirement plan, for eligible employees. Eligible employees who are at least 21 years old and have completed 90 days of service may participate in the Plan as of the first day of the following Plan quarter. Under the Plan, participants may elect to defer a portion of their compensation on a pre-tax basis, subject to annual limits established by the Internal Revenue Service, including additional catch-up contributions for employees age 50 and older. The Company makes a safe harbor nonelective contribution equal to 3% of eligible compensation for all eligible participants, regardless of whether the employee elects to make deferral contributions. All employee deferrals and employer safe harbor contributions are 100% vested. For the years ended December 31, 2024 and 2023, the Company contributed approximately $57 thousand and $42 thousand, respectively, to the Plan. These amounts are included in general and administrative expenses in the accompanying consolidated statements of operations.

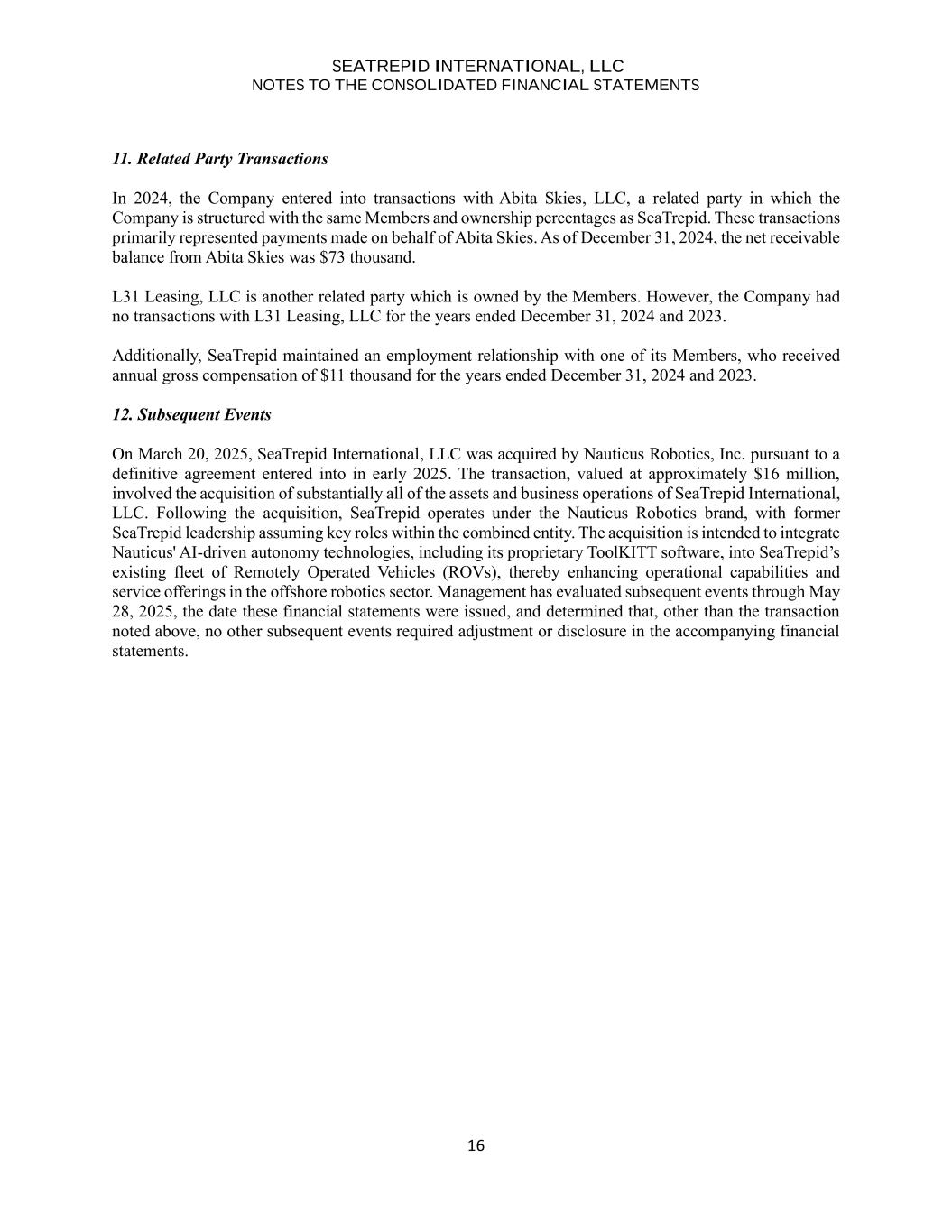

SEATREPID INTERNATIONAL, LLC NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 16 11. Related Party Transactions In 2024, the Company entered into transactions with Abita Skies, LLC, a related party in which the Company is structured with the same Members and ownership percentages as SeaTrepid. These transactions primarily represented payments made on behalf of Abita Skies. As of December 31, 2024, the net receivable balance from Abita Skies was $73 thousand. L31 Leasing, LLC is another related party which is owned by the Members. However, the Company had no transactions with L31 Leasing, LLC for the years ended December 31, 2024 and 2023. Additionally, SeaTrepid maintained an employment relationship with one of its Members, who received annual gross compensation of $11 thousand for the years ended December 31, 2024 and 2023. 12. Subsequent Events On March 20, 2025, SeaTrepid International, LLC was acquired by Nauticus Robotics, Inc. pursuant to a definitive agreement entered into in early 2025. The transaction, valued at approximately $16 million, involved the acquisition of substantially all of the assets and business operations of SeaTrepid International, LLC. Following the acquisition, SeaTrepid operates under the Nauticus Robotics brand, with former SeaTrepid leadership assuming key roles within the combined entity. The acquisition is intended to integrate Nauticus' AI-driven autonomy technologies, including its proprietary ToolKITT software, into SeaTrepid’s existing fleet of Remotely Operated Vehicles (ROVs), thereby enhancing operational capabilities and service offerings in the offshore robotics sector. Management has evaluated subsequent events through May 28, 2025, the date these financial statements were issued, and determined that, other than the transaction noted above, no other subsequent events required adjustment or disclosure in the accompanying financial statements.