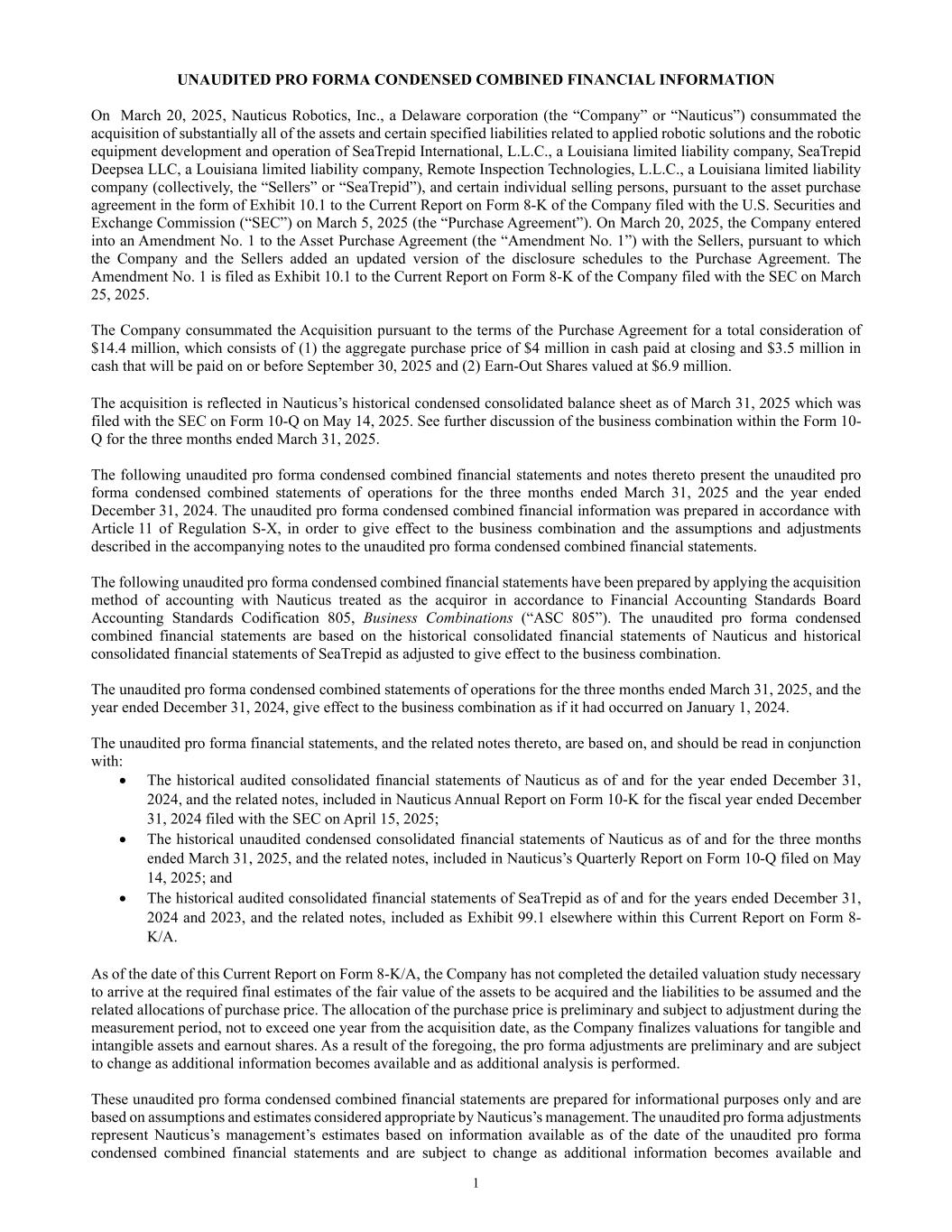

1 UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION On March 20, 2025, Nauticus Robotics, Inc., a Delaware corporation (the “Company” or “Nauticus”) consummated the acquisition of substantially all of the assets and certain specified liabilities related to applied robotic solutions and the robotic equipment development and operation of SeaTrepid International, L.L.C., a Louisiana limited liability company, SeaTrepid Deepsea LLC, a Louisiana limited liability company, Remote Inspection Technologies, L.L.C., a Louisiana limited liability company (collectively, the “Sellers” or “SeaTrepid”), and certain individual selling persons, pursuant to the asset purchase agreement in the form of Exhibit 10.1 to the Current Report on Form 8-K of the Company filed with the U.S. Securities and Exchange Commission (“SEC”) on March 5, 2025 (the “Purchase Agreement”). On March 20, 2025, the Company entered into an Amendment No. 1 to the Asset Purchase Agreement (the “Amendment No. 1”) with the Sellers, pursuant to which the Company and the Sellers added an updated version of the disclosure schedules to the Purchase Agreement. The Amendment No. 1 is filed as Exhibit 10.1 to the Current Report on Form 8-K of the Company filed with the SEC on March 25, 2025. The Company consummated the Acquisition pursuant to the terms of the Purchase Agreement for a total consideration of $14.4 million, which consists of (1) the aggregate purchase price of $4 million in cash paid at closing and $3.5 million in cash that will be paid on or before September 30, 2025 and (2) Earn-Out Shares valued at $6.9 million. The acquisition is reflected in Nauticus’s historical condensed consolidated balance sheet as of March 31, 2025 which was filed with the SEC on Form 10-Q on May 14, 2025. See further discussion of the business combination within the Form 10- Q for the three months ended March 31, 2025. The following unaudited pro forma condensed combined financial statements and notes thereto present the unaudited pro forma condensed combined statements of operations for the three months ended March 31, 2025 and the year ended December 31, 2024. The unaudited pro forma condensed combined financial information was prepared in accordance with Article 11 of Regulation S-X, in order to give effect to the business combination and the assumptions and adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial statements. The following unaudited pro forma condensed combined financial statements have been prepared by applying the acquisition method of accounting with Nauticus treated as the acquiror in accordance to Financial Accounting Standards Board Accounting Standards Codification 805, Business Combinations (“ASC 805”). The unaudited pro forma condensed combined financial statements are based on the historical consolidated financial statements of Nauticus and historical consolidated financial statements of SeaTrepid as adjusted to give effect to the business combination. The unaudited pro forma condensed combined statements of operations for the three months ended March 31, 2025, and the year ended December 31, 2024, give effect to the business combination as if it had occurred on January 1, 2024. The unaudited pro forma financial statements, and the related notes thereto, are based on, and should be read in conjunction with: • The historical audited consolidated financial statements of Nauticus as of and for the year ended December 31, 2024, and the related notes, included in Nauticus Annual Report on Form 10-K for the fiscal year ended December 31, 2024 filed with the SEC on April 15, 2025; • The historical unaudited condensed consolidated financial statements of Nauticus as of and for the three months ended March 31, 2025, and the related notes, included in Nauticus’s Quarterly Report on Form 10-Q filed on May 14, 2025; and • The historical audited consolidated financial statements of SeaTrepid as of and for the years ended December 31, 2024 and 2023, and the related notes, included as Exhibit 99.1 elsewhere within this Current Report on Form 8- K/A. As of the date of this Current Report on Form 8-K/A, the Company has not completed the detailed valuation study necessary to arrive at the required final estimates of the fair value of the assets to be acquired and the liabilities to be assumed and the related allocations of purchase price. The allocation of the purchase price is preliminary and subject to adjustment during the measurement period, not to exceed one year from the acquisition date, as the Company finalizes valuations for tangible and intangible assets and earnout shares. As a result of the foregoing, the pro forma adjustments are preliminary and are subject to change as additional information becomes available and as additional analysis is performed. These unaudited pro forma condensed combined financial statements are prepared for informational purposes only and are based on assumptions and estimates considered appropriate by Nauticus’s management. The unaudited pro forma adjustments represent Nauticus’s management’s estimates based on information available as of the date of the unaudited pro forma condensed combined financial statements and are subject to change as additional information becomes available and

2 additional analyses are performed. However, Nauticus’s management believes that the assumptions provide a reasonable basis for presenting the significant effects that are directly attributable to the business combination, and that the pro forma adjustments give appropriate effect to those assumptions and are properly applied in the unaudited pro forma condensed combined financial statements. The unaudited pro forma condensed combined financial statements do not purport to be indicative of what Nauticus’s financial condition or results of operations actually would have been if the business combination had been consummated as of the dates indicated, nor do they purport to represent Nauticus’s financial position or results of operations for future periods.

3 NAUTICUS ROBOTICS, INC. UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2024 Nauticus Historical SeaTrepid Historical Transactions Adjustments Item in Note 3 Pro Forma Combined Revenue: Service $ 1,807,472 $ 7,296,090 $ (471,535) [1] $ 8,632,027 Total revenue 1,807,472 7,296,090 (471,535) 8,632,027 Costs and expenses: Cost of revenue 9,732,205 3,954,975 (471,535) [1] 13,215,645 Depreciation 1,736,828 231,387 911,740 [2] 2,879,955 Research and development 82,850 - - 82,850 General and administrative 13,370,486 1,787,893 37,949 [3] 15,196,328 Total costs and expenses 24,922,369 5,974,255 478,154 31,374,778 Operating loss (23,114,897) 1,321,835 (949,689) (22,742,751) Other (income) expense: Other expense, net 110,361 (154,812) - (44,451) Loss on lease termination 18,721 - - 18,721 Foreign currency transaction loss 61,597 - - 61,597 Loss on extinguishment of debt 127,605,940 - - 127,605,940 Change in fair value of warrant liabilities (13,559,010) - - (13,559,010) Change in fair value of New Convertible Debentures (7,989,948) - - (7,989,948) Change in fair value of November 2024 Debentures 435,864 - - 435,864 Interest expense, net 5,108,227 289,785 - 5,398,012 Total other (income) expense, net 111,791,752 134,973 - 111,926,725 Net loss $(134,906,649) $ 1,186,862 $ (949,689) $(134,669,476) Basic and diluted loss per share $ (36.73) $ (36.66) Basic and diluted weighted average shares outstanding 3,673,197 3,673,197

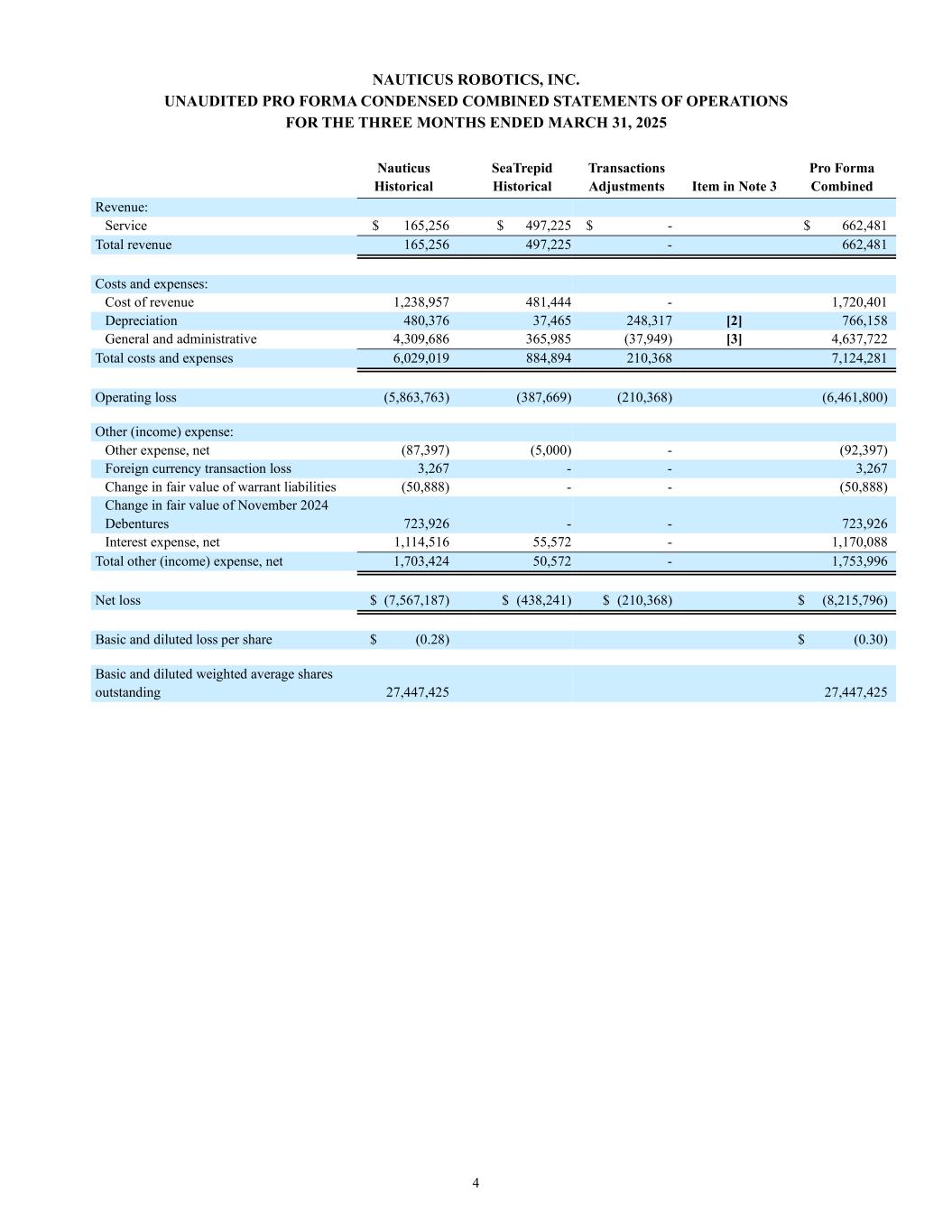

4 NAUTICUS ROBOTICS, INC. UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENTS OF OPERATIONS FOR THE THREE MONTHS ENDED MARCH 31, 2025 Nauticus Historical SeaTrepid Historical Transactions Adjustments Item in Note 3 Pro Forma Combined Revenue: Service $ 165,256 $ 497,225 $ - $ 662,481 Total revenue 165,256 497,225 - 662,481 Costs and expenses: Cost of revenue 1,238,957 481,444 - 1,720,401 Depreciation 480,376 37,465 248,317 [2] 766,158 General and administrative 4,309,686 365,985 (37,949) [3] 4,637,722 Total costs and expenses 6,029,019 884,894 210,368 7,124,281 Operating loss (5,863,763) (387,669) (210,368) (6,461,800) Other (income) expense: Other expense, net (87,397) (5,000) - (92,397) Foreign currency transaction loss 3,267 - - 3,267 Change in fair value of warrant liabilities (50,888) - - (50,888) Change in fair value of November 2024 Debentures 723,926 - - 723,926 Interest expense, net 1,114,516 55,572 - 1,170,088 Total other (income) expense, net 1,703,424 50,572 - 1,753,996 Net loss $ (7,567,187) $ (438,241) $ (210,368) $ (8,215,796) Basic and diluted loss per share $ (0.28) $ (0.30) Basic and diluted weighted average shares outstanding 27,447,425 27,447,425

5 NOTES TO THE UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION Note 1 – Basis of Presentation The Nauticus and SeaTrepid historical financial information has been derived from, in the case of Nauticus, its condensed consolidated financial statements included in its Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, and Annual Report on Form 10-K for the year ended December 31, 2024, and, in the case of SeaTrepid, its consolidated financial statements included as Exhibit 99.1 elsewhere within this Current Report on Form 8-K/A. The unaudited pro forma condensed combined financial statements should be read in conjunction with Nauticus’s and SeaTrepid’s consolidated financial statements and the notes thereto. The unaudited pro forma condensed combined statements of operations give effect to the business combination as if they had been completed on January 1, 2024. The historical financial statements of Nauticus and SeaTrepid have been adjusted in the unaudited pro forma condensed combined financial statements to give pro forma effect to the accounting for the business combination under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) (“Pro Forma Transactions Adjustments”). The unaudited pro forma condensed combined financial statements and related notes were prepared using the acquisition method of accounting in accordance ASC 805, with Nauticus treated as the acquiror of SeaTrepid. ASC 805 requires, among other things, that the assets acquired and liabilities assumed in a business combination be recognized at their fair values as of the acquisition date. For purposes of the unaudited pro forma condensed combined financial statements, the estimated preliminary purchase consideration in the business combination has been allocated to the assets acquired and liabilities assumed of SeaTrepid based upon Nauticus management’s preliminary estimate of their fair values as of the acquisition date. The allocations of the purchase price reflected in these unaudited pro forma condensed combined financial statements have not been finalized and are based upon the best available information at the current time. The allocation of the purchase price is preliminary and subject to adjustment during the measurement period, not to exceed one year from the acquisition date, as the Company finalizes valuations for tangible and intangible assets and earnout shares. The completion of the final allocation of the purchase price could cause material differences in the information presented. The unaudited pro forma condensed combined financial statements and related notes herein present unaudited pro forma condensed combined financial condition and results of operations of Nauticus, after giving pro forma effect to the Pro Forma Transactions. The business combination, the Pro Forma Transactions and the related adjustments are described in these accompanying notes to the unaudited pro forma condensed combined financial statements. In the opinion of Nauticus management, all material adjustments have been made that are necessary to present fairly, in accordance with Article 11 of Regulation S-X of the SEC, the unaudited pro forma condensed combined financial statements. The unaudited pro forma condensed combined financial statements do not purport to be indicative of the combined company’s financial position or results of operations of the combined company that would have occurred if the business combination had been completed on the dates indicated, nor are they indicative of the combined company’s financial position or results of operations that may be expected for any future period or date. Note 2 – Conforming Accounting Policies The accounting policies used in the preparation of these unaudited pro forma condensed combined financial statements are those set out in Nauticus’s audited consolidated financial statements as of and for the year ended December 31, 2024, and Nauticus’s unaudited condensed consolidated financial statements as of and for the three months ended March 31, 2025. During the preparation of this unaudited pro forma condensed combined financial information, management performed a preliminary analysis of SeaTrepid’s financial information to identify differences in accounting policies as compared to those of Nauticus. With the information currently available, Nauticus’s management has determined that there were no significant accounting policy differences between Nauticus and SeaTrepid and, therefore, no adjustments were made to conform SeaTrepid’s financial statements to the accounting policies used by Nauticus in the preparation of the unaudited pro forma condensed combined financial statements. This conclusion is subject to change as further assessment will be performed and finalized for purchase accounting. As part of the application of ASC 805, Nauticus will continue to conduct a more detailed review of SeaTrepid’s accounting policies in an effort to determine if differences in accounting policies require further reclassification or adjustment of SeaTrepid’s results of operations or reclassification or adjustment of assets or liabilities to conform to Nauticus’s accounting policies and classifications. Therefore, Nauticus may identify additional differences between the accounting policies of the two companies that, when conformed, could have a material impact on the unaudited pro forma condensed combined financial information.

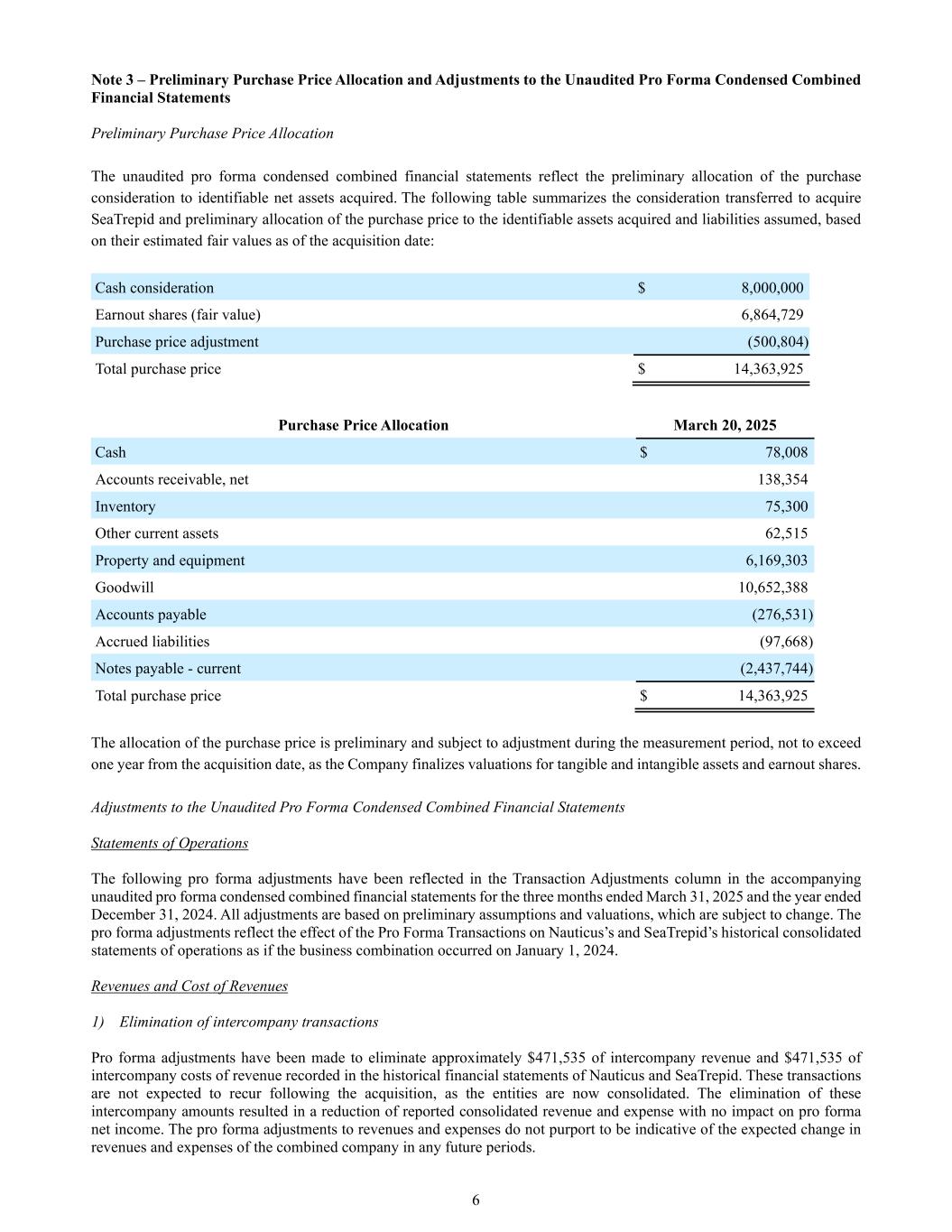

6 Note 3 – Preliminary Purchase Price Allocation and Adjustments to the Unaudited Pro Forma Condensed Combined Financial Statements Preliminary Purchase Price Allocation The unaudited pro forma condensed combined financial statements reflect the preliminary allocation of the purchase consideration to identifiable net assets acquired. The following table summarizes the consideration transferred to acquire SeaTrepid and preliminary allocation of the purchase price to the identifiable assets acquired and liabilities assumed, based on their estimated fair values as of the acquisition date: Cash consideration $ 8,000,000 Earnout shares (fair value) 6,864,729 Purchase price adjustment (500,804) Total purchase price $ 14,363,925 Purchase Price Allocation March 20, 2025 Cash $ 78,008 Accounts receivable, net 138,354 Inventory 75,300 Other current assets 62,515 Property and equipment 6,169,303 Goodwill 10,652,388 Accounts payable (276,531) Accrued liabilities (97,668) Notes payable - current (2,437,744) Total purchase price $ 14,363,925 The allocation of the purchase price is preliminary and subject to adjustment during the measurement period, not to exceed one year from the acquisition date, as the Company finalizes valuations for tangible and intangible assets and earnout shares. Adjustments to the Unaudited Pro Forma Condensed Combined Financial Statements Statements of Operations The following pro forma adjustments have been reflected in the Transaction Adjustments column in the accompanying unaudited pro forma condensed combined financial statements for the three months ended March 31, 2025 and the year ended December 31, 2024. All adjustments are based on preliminary assumptions and valuations, which are subject to change. The pro forma adjustments reflect the effect of the Pro Forma Transactions on Nauticus’s and SeaTrepid’s historical consolidated statements of operations as if the business combination occurred on January 1, 2024. Revenues and Cost of Revenues 1) Elimination of intercompany transactions Pro forma adjustments have been made to eliminate approximately $471,535 of intercompany revenue and $471,535 of intercompany costs of revenue recorded in the historical financial statements of Nauticus and SeaTrepid. These transactions are not expected to recur following the acquisition, as the entities are now consolidated. The elimination of these intercompany amounts resulted in a reduction of reported consolidated revenue and expense with no impact on pro forma net income. The pro forma adjustments to revenues and expenses do not purport to be indicative of the expected change in revenues and expenses of the combined company in any future periods.

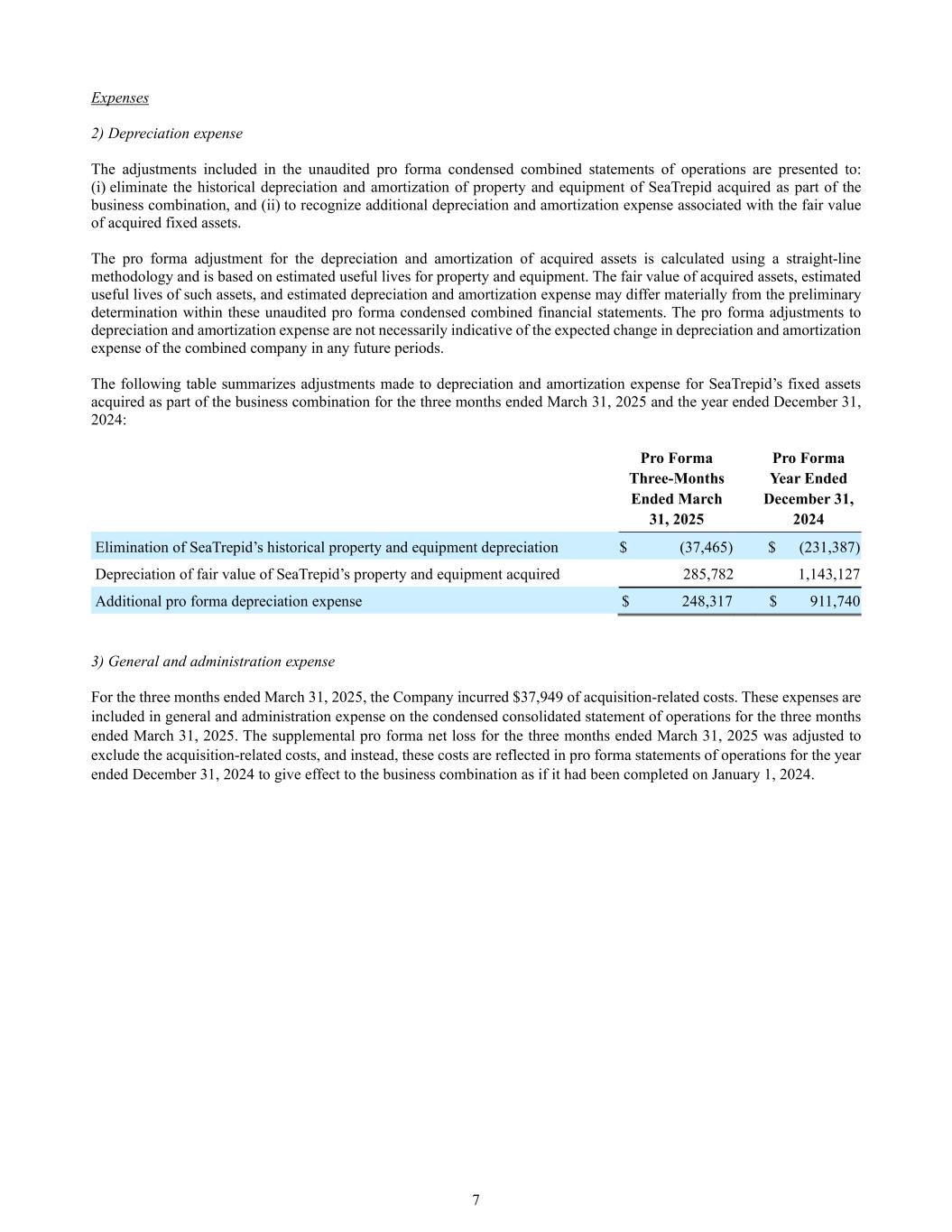

7 Expenses 2) Depreciation expense The adjustments included in the unaudited pro forma condensed combined statements of operations are presented to: (i) eliminate the historical depreciation and amortization of property and equipment of SeaTrepid acquired as part of the business combination, and (ii) to recognize additional depreciation and amortization expense associated with the fair value of acquired fixed assets. The pro forma adjustment for the depreciation and amortization of acquired assets is calculated using a straight-line methodology and is based on estimated useful lives for property and equipment. The fair value of acquired assets, estimated useful lives of such assets, and estimated depreciation and amortization expense may differ materially from the preliminary determination within these unaudited pro forma condensed combined financial statements. The pro forma adjustments to depreciation and amortization expense are not necessarily indicative of the expected change in depreciation and amortization expense of the combined company in any future periods. The following table summarizes adjustments made to depreciation and amortization expense for SeaTrepid’s fixed assets acquired as part of the business combination for the three months ended March 31, 2025 and the year ended December 31, 2024: Pro Forma Three-Months Ended March 31, 2025 Pro Forma Year Ended December 31, 2024 Elimination of SeaTrepid’s historical property and equipment depreciation $ (37,465) $ (231,387) Depreciation of fair value of SeaTrepid’s property and equipment acquired 285,782 1,143,127 Additional pro forma depreciation expense $ 248,317 $ 911,740 3) General and administration expense For the three months ended March 31, 2025, the Company incurred $37,949 of acquisition-related costs. These expenses are included in general and administration expense on the condensed consolidated statement of operations for the three months ended March 31, 2025. The supplemental pro forma net loss for the three months ended March 31, 2025 was adjusted to exclude the acquisition-related costs, and instead, these costs are reflected in pro forma statements of operations for the year ended December 31, 2024 to give effect to the business combination as if it had been completed on January 1, 2024.