Filed Pursuant to Rule 424(b)(3)

Registration No. 333-267375

PROSPECTUS SUPPLEMENT NO. 4

(to prospectus dated April 18, 2023)

NAUTICUS ROBOTICS, INC.

8,275,000 Shares of Common Stock

Up to 8,625,000 Shares of Common Stock Underlying Public Warrants to Purchase Common Stock

Up to 7,175,000 Shares of Common Stock Underlying Private Warrants to Purchase Common Stock

Up to 2,922,425 Shares of Common Stock Underlying Securities Purchase Agreement Warrants to Purchase Common Stock

Up to 2,922,425 Shares of Common Stock Underlying Convertible Debentures

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated April 18, 2023 (the “Prospectus”), with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May 30, 2023 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale by us of (i) 862,500 shares of common stock, par value $0.0001 per share (“Common Stock”), of Nauticus Robotics, Inc. (the “Company”) which were issued upon the conversion of the rights to receive one twentieth (1/20) of one share of Common Stock (the “Right Shares”) in connection with the closing of the Business Combination (defined below), (2) 8,625,000 shares of Common Stock (the “Public Warrant Shares”) issuable upon the exercise of 8,625,000 redeemable warrants, which are exercisable at a price of $11.50 per share (the “Public Warrants”) and (3) 7,175,000 shares of Common Stock (the “Private Warrant Shares”) issuable upon the exercise of 7,175,000 redeemable warrants, purchased by CleanTech Sponsor I LLC and CleanTech Investments, LLC (together, the “Co-sponsors”) at a price of $1.00 per Private Warrant pursuant to a subscription agreement entered into in connection with CLAQ’s (defined below) initial public offering (“IPO”), which are exercisable at a price of $11.50 per share (the “Private Warrants”).

The Prospectus and this prospectus supplement also relate to the resale from time to time by the selling securityholders named in the Prospectus or their permitted transferees (the “Selling Securityholders”) of (i) 4,312,500 shares of Common Stock (the “Founder Shares”) that were issued to the Co-sponsors in conjunction with the IPO at a purchase price equivalent to approximately $0.00058 per Founder Share and subsequently converted upon the closing of the Business Combination and (ii) 3,100,000 shares of Common Stock purchased by certain Selling Securityholders at a price of $10.00 per share of Common Stock, and issued pursuant to the terms of certain subscription agreements entered into in connection with the Business Combination pursuant to the Merger Agreement (the “Merger Agreement,” and together with the other agreements and transactions contemplated thereby, the “Business Combination”) by and among CleanTech Acquisition Corp. (“CleanTech” or “CLAQ”), Nauticus Robotics Holdings, Inc. (formerly known as “Houston Mechatronics, Inc.”), a Texas corporation (“Nauticus Robotics Holdings”), and CleanTech Merger Sub, Inc. (“Merger Sub”), a wholly-owned subsidiary of CleanTech. Pursuant to the Merger Agreement, in connection with the consummation of the Business Combination Merger Sub merged with and into Nauticus Robotics Holdings, with Nauticus Robotics Holdings surviving the merger as a wholly owned subsidiary of the Company, and the Company was renamed “Nauticus Robotics, Inc.”

Further, the Prospectus and this prospectus relate to the offer and sale by us of (i) 2,922,425 shares of Common Stock (the “SPA Warrant Shares”) which have been or may be issued from time to time upon the exercise of 2,922,425 warrants that were issued to certain Selling Securityholders (the “SPA Investors”) pursuant to the SPA, with an exercise price of $20.00 per share (the “SPA Warrants”) and (ii) 2,922,425 shares of Common Stock (the “Debenture Shares” and together with the SPA Warrant Shares, the “SPA Shares”) issuable upon the conversion of the Debentures (defined below) that were purchased by certain Selling Securityholders pursuant to the SPA, with a conversion price of $15.00 per share. Pursuant to the Securities Purchase Agreement by and among the Company, Nauticus Robotics Holdings, and the SPA Investors (the “SPA”), the SPA Investors subscribed for Debentures in an aggregate principal amount of $36,530,320. In exchange, for such subscriptions, Nauticus delivered to such Selling Securityholders (i) a Debenture with a principal amount equal to such Selling Securityholder’s subscription amount and (ii) SPA Warrants.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, any may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Common Stock is listed on the Nasdaq Stock Market LLC under the symbol “KITT.” On July 21, 2023, the closing price for our Common Stock was $2.05 per share.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 12 of the Prospectus. Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 24, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 23, 2023

NAUTICUS ROBOTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40611 | 85-1699753 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

17146 Feathercraft Lane, Suite 450, Webster, TX 77598

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code: (281) 942-9069

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name

of each exchange on which registered | ||

| Common Stock | KITT | The Nasdaq Stock Market LLC | ||

| Warrants | KITTW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

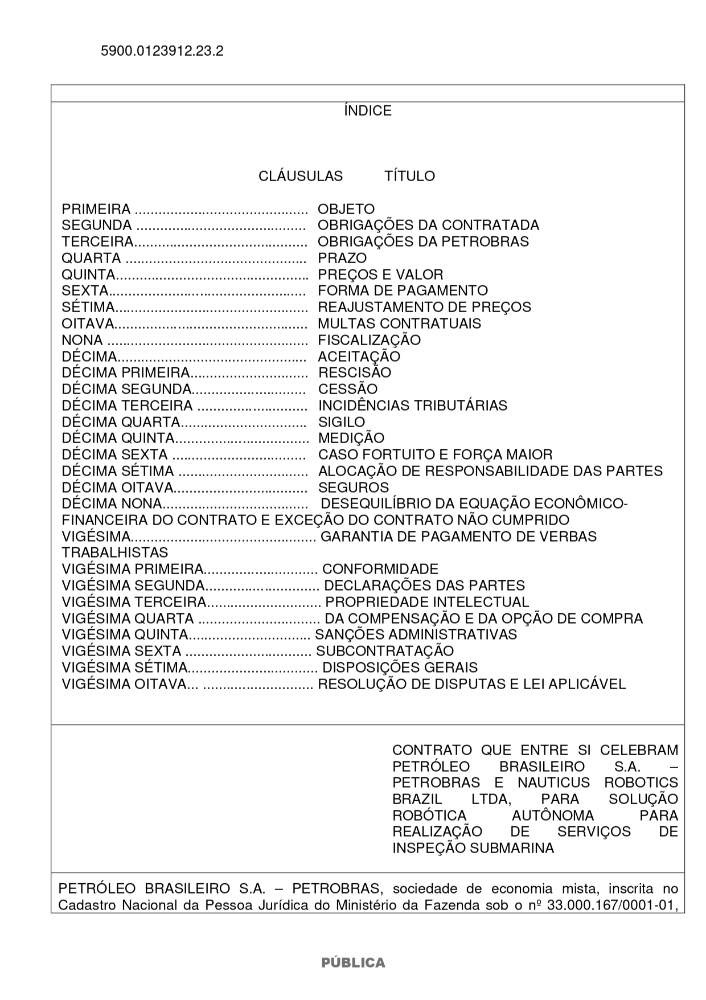

On May 23, 2022, Nauticus Robotics Brazil Ltda., a Brazilian limited liability company (the “Company”) and a wholly owned subsidiary of Nauticus Robotics, Inc., a Delaware corporation, entered into an agreement (the “Agreement”) by and between the Company and Petróleo Brasileiro S.A., a Brazilian limited liability corporation (“Petrobras”), pursuant to which, among other things and upon the terms and subject to the conditions set forth therein, the Company will provide Petrobras with underwater inspection services through the use of Aquanaut, the Company’s autonomous subsea robotic system.

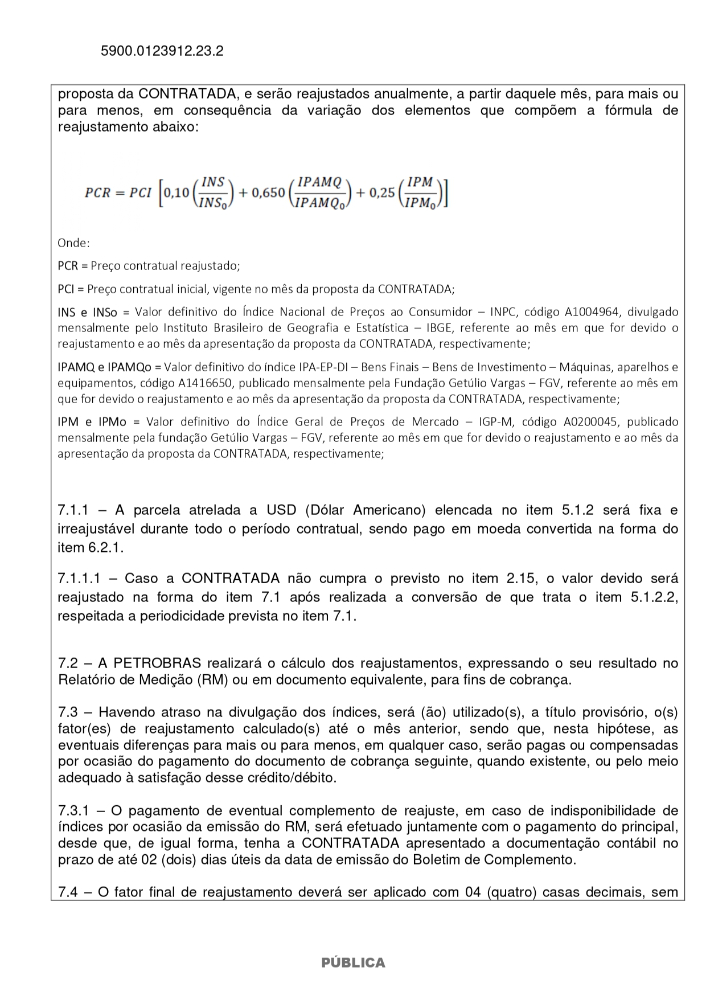

Unless otherwise terminated or suspended under the terms of the Agreement, the term of the Agreement is 1,080 days, and Petrobras agrees to pay the Company a fixed fee of approximately BRL 21.6 million (approximately USD 4.3 million), subject to the payment conditions and schedules set forth in the Agreement.

The Agreement contains customary representations and warranties and various customary covenants made by each party. Among other terms, the Company agrees to: comply with local labor laws, provide a health assurance plan to certain employees, repair any defects or faults with its equipment, comply with Petrobras’ information security standards and communicate any violations of such standards, and procure and maintain, throughout the entire term of the Agreement, insurance coverage for risks associated with the execution of the services. Among other terms, Petrobras agrees to make timely payments to the Company, adopt information security measures to protect personal data in compliance with applicable laws, provide the Company with adequate instructions and specifications, and issue requisite authorizations for the Company to execute the services under the Agreement.

Each of the Company and Petrobras has agreed to indemnify the other for certain damages and losses arising out of services provided under the Agreement, including damages and losses to equipment, facilities, and materials, subject to customary limitations. The services provided by the Company under the Agreement are subject to regular inspection by Petrobras. Petrobras reserves the right to reject or accept any work performed under the Agreement that does not comply with the requirements set forth therein and the technical specifications provided pursuant to the Agreement.

The Agreement contains termination rights for each of the Company and Petrobras, including, among other things, terms in which Nauticus may terminate the Agreement in the event of a delay in payment or release of equipment by Petrobras and in which Petrobras may terminate the Agreement without compensation or retention of the Company’s services in the event of certain breaches or non-compliance under the Agreement. Under certain conditions, the Company may be liable for damages up to 100% of the readjusted Agreement value, and the Company may be obligated to reimburse Petrobras if it is unable to provide a feasible technological solution. Further, Nauticus may be subject to monetary non-compliance penalties pursuant to compliance thresholds specified by the Agreement.

The foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference. It is not intended to provide any other factual information about the Company or Petrobras. In particular, the assertions embodied in the representations, warranties, covenants, and agreements contained in the Agreement were made only for purposes of the Agreement, were solely for the benefit of the parties to the Agreement, and are qualified by information in confidential disclosure schedules provided by the parties to the Agreement in connection with the signing of the Agreement. These confidential disclosure schedules contain information that modifies, qualifies, and creates exceptions to the representations, warranties, covenants, and agreements set forth in the Agreement. Moreover, certain representations, warranties, covenants, and agreements in the Agreement were used for the purpose of allocating risk between the Company and Petrobras rather than establishing matters as facts and were made only as of the date of the Agreement (or such other date or dates as may be specified in the Agreement). In addition, the parties may apply standards of materiality in a way that is different from what may be viewed as material by investors. Accordingly, the representations, warranties, covenants, and agreements in the Agreement may not describe the actual state of affairs at the date they were made or at any other time and should not be relied upon as characterizations of the actual state of facts about the Company or Petrobras. Moreover, information concerning the subject matter of the representations, warranties, covenants, and agreements may change after the date of the Agreement, and, unless required by applicable law, the Company undertakes no obligation to update such information.

1

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 10.1†* | Agreement by and between Nauticus Robotics Brazil Ltda. and Petróleo Brasileiro S.A. entered into on May 23, 2023. | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

| † | Schedules and similar attachments to this Exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the U.S. Securities and Exchange Commission (the “SEC”) upon request. |

| * | Certain portions of this Exhibit have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K. The omitted information is (i) not material and (ii) would likely cause competitive harm to the Company if publicly disclosed. The Company agrees to furnish supplementally an unredacted copy of this Exhibit to the SEC upon request. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Nauticus Robotics, Inc. | ||

| By: | /s/ Nicolaus Radford | |

| Nicolaus Radford | ||

| Chief Executive Officer | ||

Date: May 30, 2023

3